Hey!

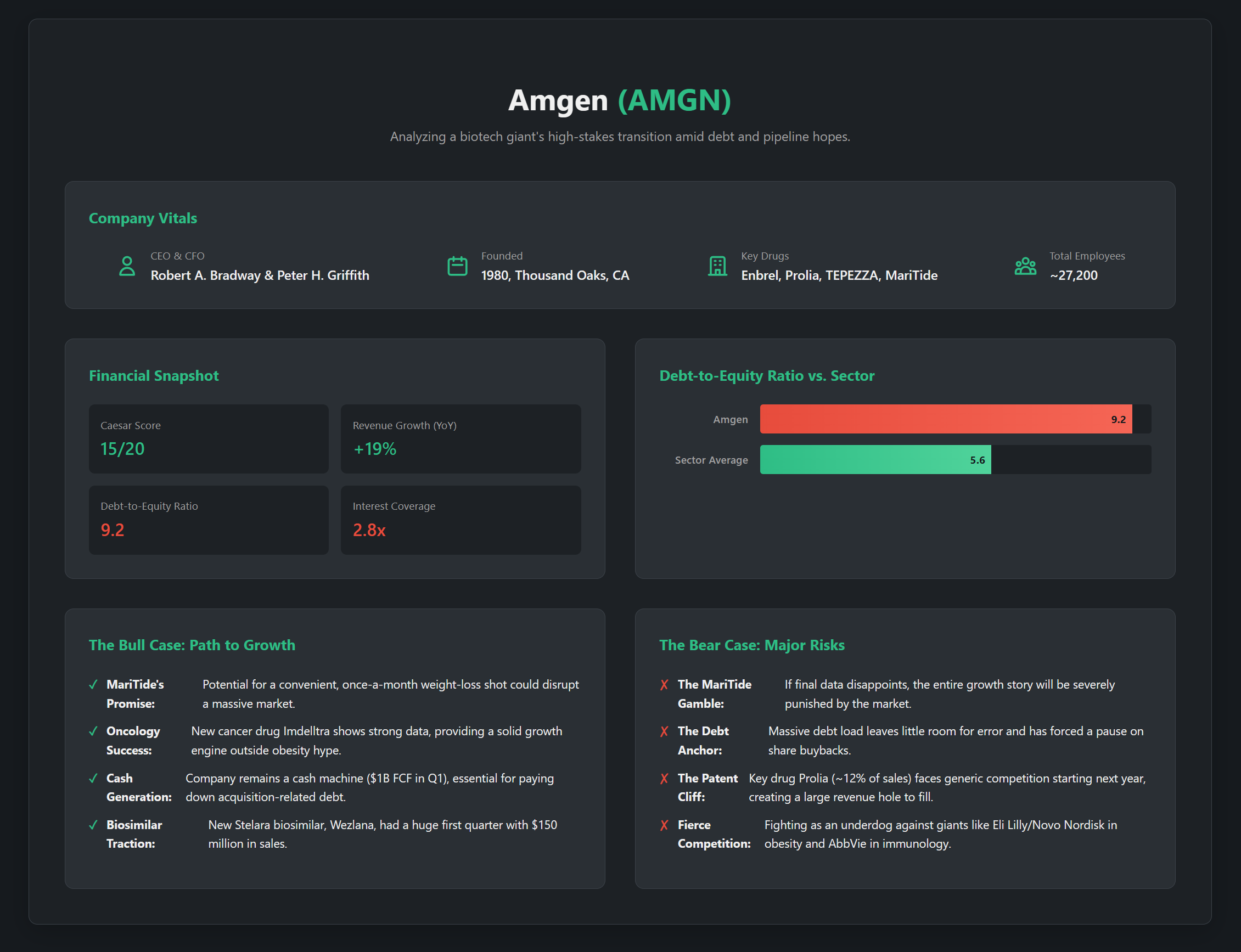

Today we're looking at Amgen AMGN 0.00%↑ . The stock has been bouncing around after a big run-up and then a pullback earlier in the year. It's a pharma giant trying to pull off a tricky transition, and a lot of its future hinges on what happens in the next few months. Let's see what the numbers tell us.

🎧 If you prefer to listen, scroll down to the Members section for a podcast!

Quick Summary

Breaking Down the Business

Amgen is one of the world's original biotech companies. For years, they've made money from blockbuster drugs like Enbrel (for arthritis) and Prolia (for osteoporosis). Think of these as their old, reliable cash cows.

The problem is, the patents on these drugs are expiring. That means cheaper generic or "biosimilar" versions will flood the market, and Amgen's sales will drop. Prolia, which makes up about 12% of their sales, starts facing this problem next year. That's a huge hole to fill.

So, Amgen is doing two things:

They bought growth: They spent $28 billion to buy Horizon Therapeutics. This gave them a new portfolio of drugs for rare diseases, like TEPEZZA.

They're betting big on the future: They have a very promising pipeline, led by a potential weight-loss drug called MariTide.

Essentially, Amgen is using the cash from its old drugs and a whole lot of borrowed money to build a new engine for the company.

85% of the article left

Read on for my bespoke graphs, detailed analysis, entry points, and complete trading strategy with exact support/resistance levels.