Hey folks!

Welcome to NASDUCK Weekly Podcast. This time, aside from the audio itself, I’ve prepared some cliff notes for you to enjoy:

Key Takeaways 📝

Defensive stocks (staples, healthcare, utilities) typically hold up better during market uncertainty

Cyclical stocks (tech, consumer discretionary) often drop more in downturns but bounce back stronger in recoveries

Market signals like VIX spikes and weakening consumer confidence can help time sector rotations

Back-testing shows reducing cyclical exposure during high uncertainty generally improves long-term returns

What Are We Talking About? 🤔

When markets get stormy, not all stocks react the same way. Some sectors tend to weather the storm better, while others take a bigger hit. Understanding this pattern can help you adjust your portfolio before major downturns.

How We Identify Uncertain Periods 🔍

You know uncertainty is rising when:

The VIX index (market's "fear gauge") jumps above 30 (normal is around 20)

Consumer confidence starts dropping rapidly

The yield curve inverts (short-term rates higher than long-term rates)

Credit spreads widen (companies pay much more to borrow than the government)

Major uncertain periods in recent history include the 2008 financial crisis, 2011 European debt crisis, late 2018 trade tensions, and the 2020 COVID crash.

Defensive vs. Cyclical Sectors: What's the Difference? ⚖️

Defensive sectors sell products and services people need regardless of economic conditions:

Consumer staples (groceries, household items)

Healthcare (medicine, treatments)

Utilities (electricity, water)

These companies typically have steady earnings even during recessions.

Cyclical sectors sell products people can delay or skip during tough times:

Technology (new gadgets, software)

Consumer discretionary (travel, restaurants, luxury)

Industrials (machinery, manufacturing)

These companies' profits tend to rise and fall with the economy.

How They Perform During Market Stress 📉

Defensive sectors typically:

Fall less during market downturns

Have lower volatility (smaller price swings)

Maintain more stable earnings

Recover more quickly

Cyclical sectors typically:

Drop more sharply in downturns

Experience bigger price swings

See greater earnings declines

May rebound more strongly in recoveries

For example, during the 2008 financial crisis, defensive sectors still lost money but significantly outperformed cyclicals. While the overall market fell 57%, consumer staples and healthcare held up much better than financials or consumer discretionary stocks.

What Drives These Performance Differences? 🔄

Several factors trigger rotations between defensive and cyclical sectors:

Economic indicators: When retail sales disappoint or unemployment rises, investors shift toward defensive stocks since people still need to buy food and medicine even when they cut back on everything else.

Policy changes: Interest rate cuts often signal economic weakness ahead. Historically, defensive sectors outperform in the six months following initial rate cuts.

Geopolitical events: Trade wars, international conflicts, and pandemics usually hit globally-exposed cyclical companies harder than domestically-focused defensive ones.

Investment Strategy: When to Get Defensive 🛡️

Watch for warning signs:

VIX staying above 30

Consumer confidence falling for several months

Yield curve inversion deepening

Corporate earnings warnings increasing

When uncertainty rises:

Gradually shift more of your portfolio toward defensive sectors

Focus on quality companies with strong balance sheets and consistent dividends

Consider scaling back high-beta tech and consumer discretionary positions

When uncertainty fades:

Start rotating back toward cyclicals as indicators improve

Don't switch all at once - move in stages as confidence returns

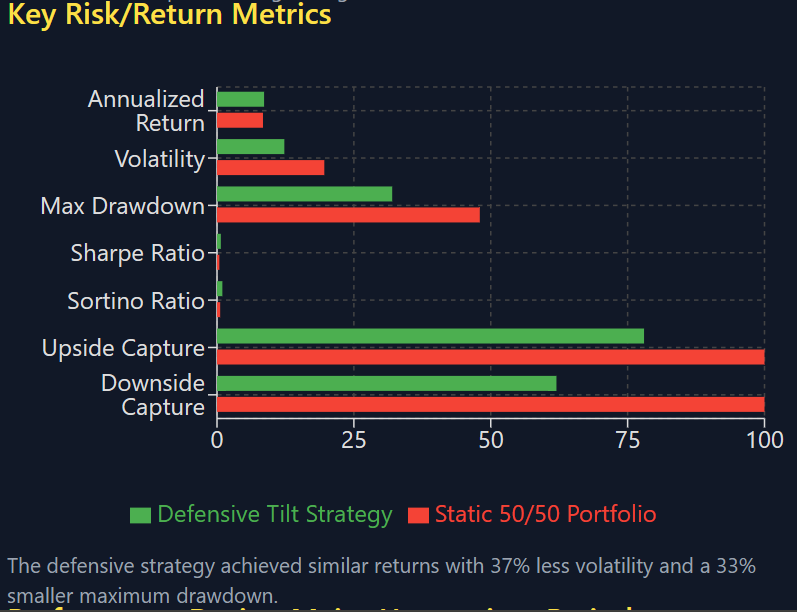

Does This Strategy Actually Work? 🧪

Back-testing shows that tilting toward defensive sectors during high uncertainty periods has historically:

Reduced maximum drawdowns (smaller losses in bear markets)

Improved risk-adjusted returns (better returns for the amount of risk taken)

Provided a smoother ride with less volatility

Created better long-term results by avoiding the worst market drops

For example, during major downturns, a defensive-tilted portfolio might fall 25-30% versus 40-50% for a static portfolio.

Real-World Application 🌐

Simple steps for most investors:

Set up a system to monitor key uncertainty indicators

Create a plan for gradually shifting allocation when signals trigger

Don't try to time perfectly - move in stages (perhaps 10% at a time)

Be patient during transitions - defensive positioning might underperform briefly before it pays off

Remember: The goal isn't to avoid all losses but to reduce them enough that your portfolio can recover faster and compound more effectively over time.

Final Thoughts 💡

Market uncertainty is inevitable. Rather than hoping to avoid it, having a systematic plan to adjust your sector exposure can significantly improve your long-term results. By getting more defensive when storm clouds gather and more aggressive when they clear, you can potentially achieve better returns with less stress along the way.

Tilting away from high-flying tech stocks during uncertain times isn't easy emotionally, but the data shows it's often the right move for preserving capital when it matters most.

Share this post