Hey!

Today we're looking at GE HealthCare ( GEHC 0.00%↑ ). Right now, they're doing pretty well in terms of getting orders and making new products, but they've been hit by some unexpected import taxes – tariffs – that are causing a bit of a storm for their profits this year. Let's see what the numbers tell us.

🎧 If you prefer to listen, scroll down to the Members section for a podcast about this post.

Quick Summary (TL;DR)

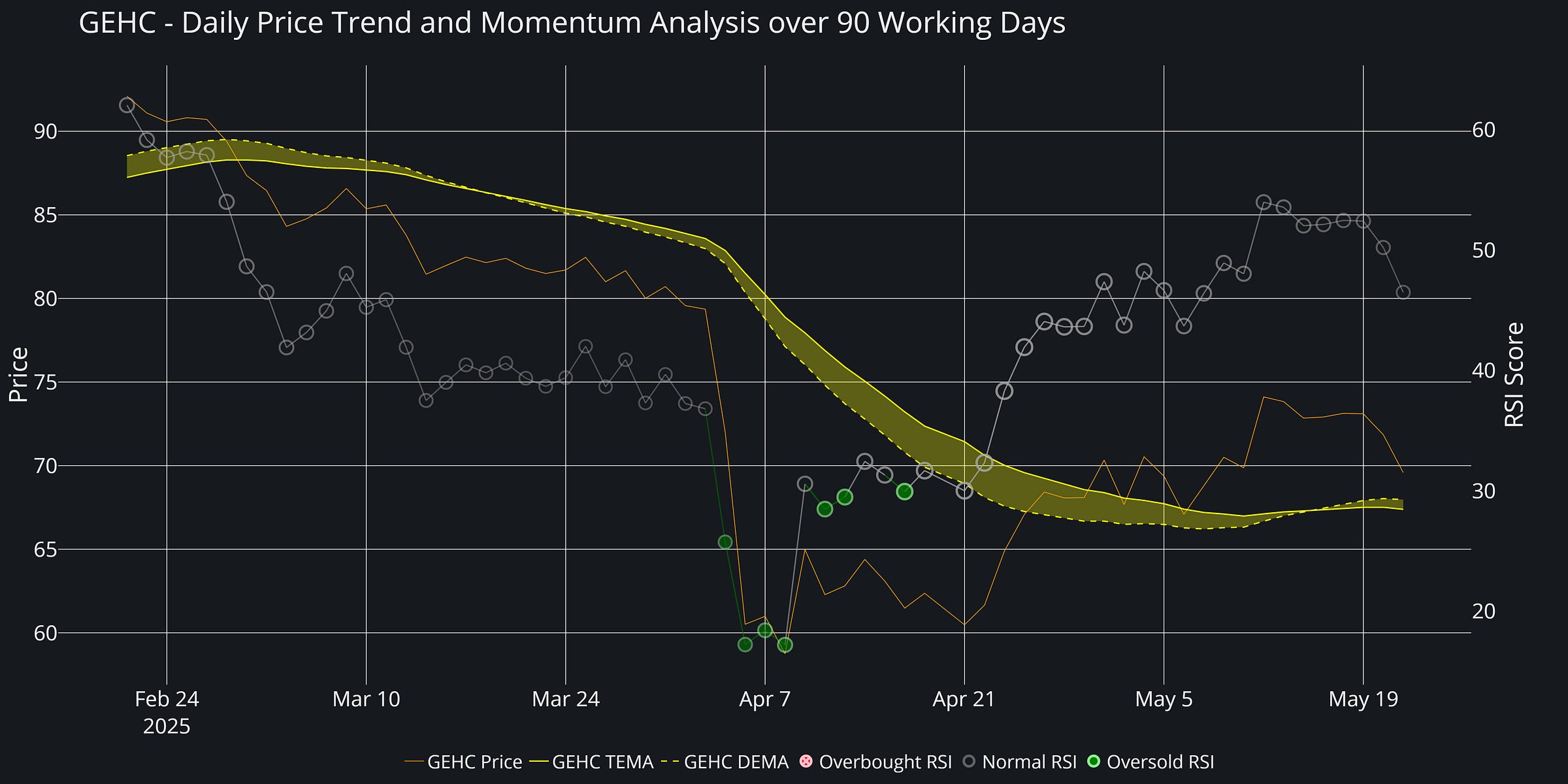

The stock (GEHC) has taken a dive, trading near $69.58, mainly because these new tariffs are going to cost them a fair bit of money in 2025.

Business & Innovation: 🟩 (Core business is solid, lots of new tech in the pipeline)

The Numbers: 🟨 (Making money, but tariffs are a big dent; debt is managed well, but profit per dollar of shareholder money could be better)

Growth Prospects: 🟨 (Orders are strong, which is great, but the profit forecast for this year got a big haircut)

Competition: 🟩 (Holding their own against the big guys, and their focus on AI and special diagnostic materials looks smart)

The Future & Tariffs: 🟨 (It all boils down to how quickly they can dodge these tariff bullets. If they can, things look up.)

Breaking Down the Business

So, what does GE HealthCare actually do? Imagine the big, tube-like MRI machines at the hospital that doctors use to see inside your body – GEHC makes those. They also make the ultrasound machines that, for example, let expectant parents see their baby, or help doctors check out injuries like a torn muscle.

Then there's "Patient Care Solutions" – think of the monitors by a hospital bed tracking heart rate and oxygen, or anesthesia machines in operating rooms. And finally, "Pharmaceutical Diagnostics." This is a fancy term for special substances, like dyes or radioactive tracers, that doctors use to make things show up better on scans. For example, it can help them spot cancer or see how well blood is flowing to the heart.

Why does this matter? Well, this equipment and these substances are vital. Doctors rely on them every day to diagnose illnesses accurately, monitor patients, and guide treatments. Without this tech, modern medicine wouldn't be nearly as effective. GEHC is a big player in making sure hospitals and clinics have these tools.

My Deep Dive

Read on for my breakdown of the numbers, what’s really going on with these tariffs, how GEHC stacks up against its rivals, and my long-term game plan for the stock, including when I'd consider buying.