Hey!

Before we start, let me preface this with a message.

Our special Black Friday event coming in 5 days

with something for Lifetime Members, Members, and Free Subscribers as well.

Stay tuned. You don’t want to miss it. All will be revealed soon. Now, without further ado…

Ever wonder why some traders consistently get better prices than others? You need to pick the right stocks but you also need to know exactly how to get in and out of them. Today, I'm breaking down the four essential order types every serious investor needs to master, plus some advanced strategies that separate the pros from the amateurs.

Whether you're new to trading or looking to step up your game, this guide will help you execute trades like a pro while managing your risks.

Your Go-To Order Types

There are four heavy hitters you'll be using most often.

1. Market Orders

It’s the simplest type of order. Here you value speed above everything else.

In other words:

Get me in (or out) ASAP, I don't care about the price!

Why use it?

The stock you’re trading has EXTREME liquidity

You’re only processing a small number of shares

You absolutely, positively need to execute right this second

Upsides:

It’s the fastest possible trade

As long as there is anybody on the other side (be it buyers or sellers), you're guaranteed to get your order filled

There is but one downside, but it’s one not to be taken lightly:

You have no control over the execution price, so in volatile markets, you could be in for a nasty surprise

🟨 Use these sparingly and at your own peril. Market orders are the fast food of stock trading. They’re convenient, but not always good for your (financial) health.

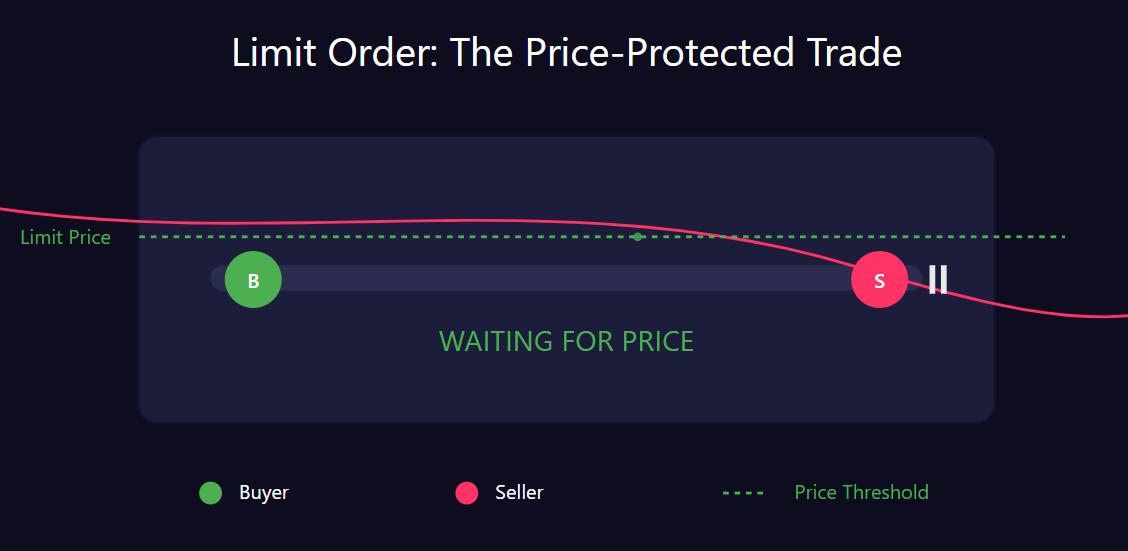

2. Limit Orders

Here, you're setting a specific price (or better) for your trade.

In other words:

"I won't sell for a penny less than X, or buy for a penny more than Y."

Why use it?

Price matters more than immediate execution

Your stock’s liquidity is neutral or low

You're trying to snag a bargain or maximize your selling price

Pros:

You're in control of the price

Potential for price improvement

Great for thinly traded stocks or large orders

Cons:

No guarantee your order will ever come through. The market has to reach your price first

If you want to buy low, you might miss out if the stock price takes off without you

🟩 It’s the best option for most trades. Unless you’re a billionaire with a dominatrix on speed dial, limit orders are how you avoid nasty surprises.

3. Stop-Loss Orders

Stop loss orders are sell orders.

First, you set a stop price below the current market price.

If the stock hits that price, your order instantly turns into a market order, so it executes as fast as it can.

In other words:

If this stock drops to $X, bail me out immediately. I don’t care about the price.

Why use it?

Limits potential losses (hence the name "stop-loss")

Protects profits on a winning position

You can't constantly monitor the market

Pros:

Automatic risk management

Lets you sleep at night without worrying about a market crash

Cons:

Can be triggered by short-term price fluctuations

No guarantee on the execution price

🟨 Highly volatile stocks can trigger your stops prematurely. Consider setting your stops wider!

Most regular stops don't work in pre-market or after-hours trading. A gap down at the open could blow right through your stop.

Beware of stop hunters: In some thinly traded stocks, big players might push the price down just to trigger stop orders and create a cascading sell-off. Don't make your stops too obvious (like right at whole number prices).

Real-world example: Let's say you bought GameStop (GME) at $200 during the meme stock craze. You set a stop-loss at $180 to limit your potential loss. If GME drops to $180, your stop-loss kicks in, selling at the next available price. But if this happens during a trading halt and the stock gaps down to $150, that's where you'll sell. Ouch!

4. Stop-Limit Orders

This is a bit trickier variant of the stop-loss order.

You set two prices: the stop price and the limit price.

When the stock hits the stop price, it triggers a limit order at the limit price.

The order will only execute at the limit price or better.

In other words:

If the stock hits $X, start selling, but don't you dare let it go for less than $Y!

Why use it?

More control than a regular stop order

Your stock is volatile (i.e. keeps jumping up and down unexpectedly)

You don’t mind the risk of not selling at all in exchange for price protection

Pros:

More control over your execution price

Protects against extreme gaps down

Cons:

Risk of no execution if the stock blows past your limit price

Can be complex to set up correctly

🟩 They’re great, but don’t make them your only line of defense!

Real-world example: Back to our GME scenario. You bought at $200, set a stop price at $180, and a limit price at $175. If GME drops to $180, your limit order at $175 activates. If the stock continues to fall but bounces between $176 and $180, your order won't execute. If it gaps down to $170, again, no execution. You're still holding the bag, but at least you didn't sell at $150!

5. Specialized Orders 🟨

Good-Till-Cancelled (GTC): Stays active until you say otherwise (or your broker gets tired of it)

Day Orders: Valid only for the trading day - use it or lose it

Fill-or-Kill (FOK): The trading equivalent of "all or nothing"

All-or-None (AON): Similar to FOK, but can hang around waiting to be fully filled

Immediate-or-Cancel (IOC): The "I want it now, but I'll take what I can get" order

Trailing Stop Orders: A stop order that moves with the stock price - clever, right? I’ve already written about the merits of those in one of my previous posts.

One-Cancels-the-Other (OCO): A pair of orders playing musical chairs - when one executes, the other disappears

Iceberg Orders: For when you want to buy a boatload of shares without making waves

These are the power tools of trading. They can be incredibly useful in the right situations, but you need to know what you're doing. Don't just start flinging these around because they sound cool.

If you want me to analyze them all in-depth, let me know and I’ll be sure to make that a post on NASDUCK!

🔒 Members Only 🔒

Advanced Order Strategies

Thought that was it? Not even close! These strategies are where the pros separate themselves from the amateurs.

Combining Order Types 🟩

Here are some of my favorite combos: