Welcome to another NASDUCK FREE WEEK post! Grab your coffee, because this week's NASDUCK Duel is a fascinating clash of strategies. We're pitting a company that's gone all-in on Bitcoin against a powerhouse in the cloud data and AI space. This is Rick Sullivan, and we're about to see who comes out on top.

🥊 This Week's Contenders 🥊

First up, we have MicroStrategy, which now goes by the name "Strategy" (ticker MSTR 0.00%↑ ). These guys have been around since 1989, originally known for their business intelligence software. But let's be honest, since 2020, their big story, led by Michael Saylor, has been their massive bet on Bitcoin. They’ve scooped up an incredible amount – as of mid-May 2025, we're talking about 568,840 Bitcoin, worth around $59 billion! They still have their software business, focusing on an AI-powered analytics platform called "Strategy One," but it's clear Bitcoin is now driving the bus. Their stock has seen some wild rides, up a staggering 499% in the last year, mostly tied to Bitcoin's price. However, their revenues from the software side have been slipping, and they've reported huge impairment losses due to accounting rules for digital assets.

In the other corner, we've got Snowflake (ticker SNOW 0.00%↑ ). These folks are all about the cloud – specifically, their "AI Data Cloud" platform. They help companies store, process, and analyze massive amounts of data, and they're deeply integrated with AI development. Think of them as providing the sophisticated plumbing and tools for big businesses to make sense of their data and build smart applications. Snowflake has been growing like a weed, boasting over 11,000 customers, including a lot of big names from the Forbes Global 2000 list. They've been showing strong revenue growth, guiding for over $4 billion in product revenue for fiscal 2026, and investors have rewarded them with a solid stock performance.

So, we've got MSTR, the Bitcoin-heavy tech company with a side of AI software, versus SNOW, the pure-play AI and data cloud giant. Let's see how they stack up in the numbers.

📊 The Duel 📊

(🔓 UNLOCKED FOR NASDUCK FREE WEEK!)

We put these two through the wringer, looking at everything from recent performance to what the crystal ball (analyst estimates) says about the future. Here’s the blow-by-blow:

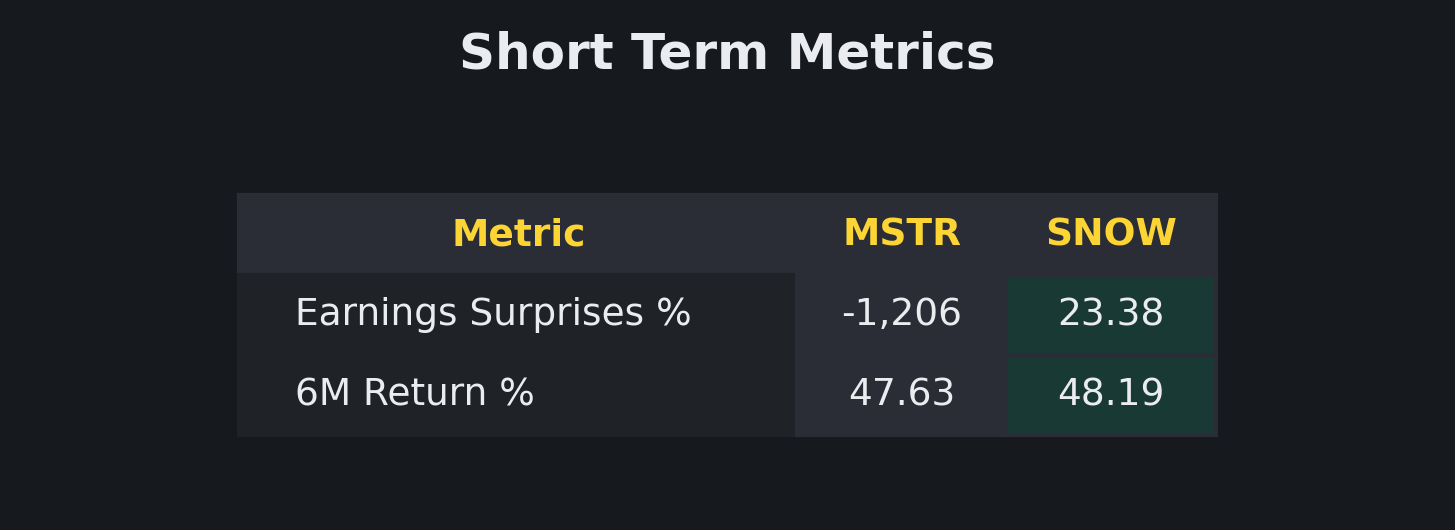

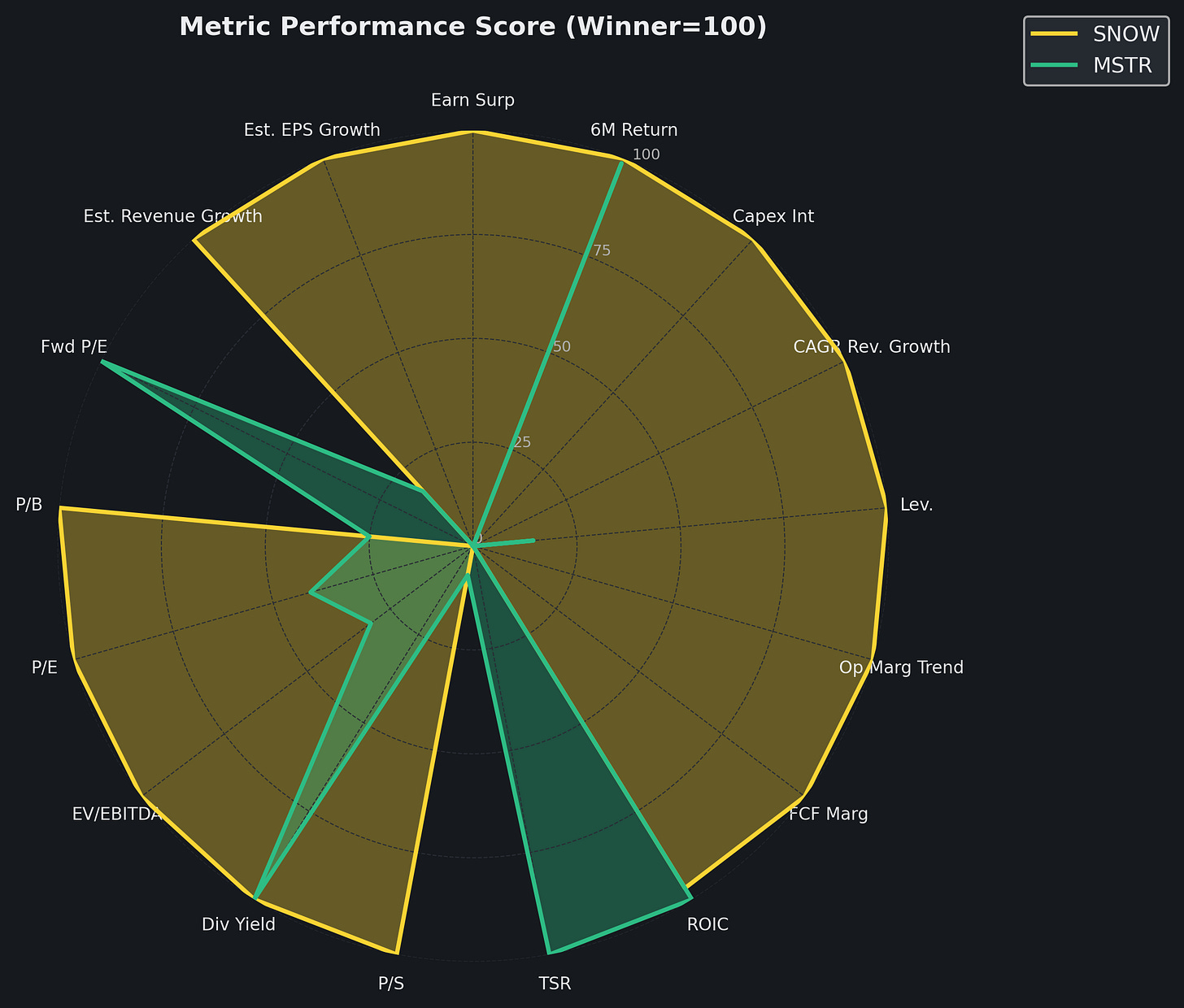

Short-Term Snapshot (0-6 Months):

Right out of the gate, SNOW takes the lead. It came out ahead on earnings surprises, meaning it's been beating Wall Street's profit expectations more impressively than MSTR. In fact, MSTR had a massive negative surprise. SNOW also edged out MSTR in 6-month stock return, showing slightly better recent momentum in the market. So, in the very recent past, SNOW seems to have had the better "feel" for investors.

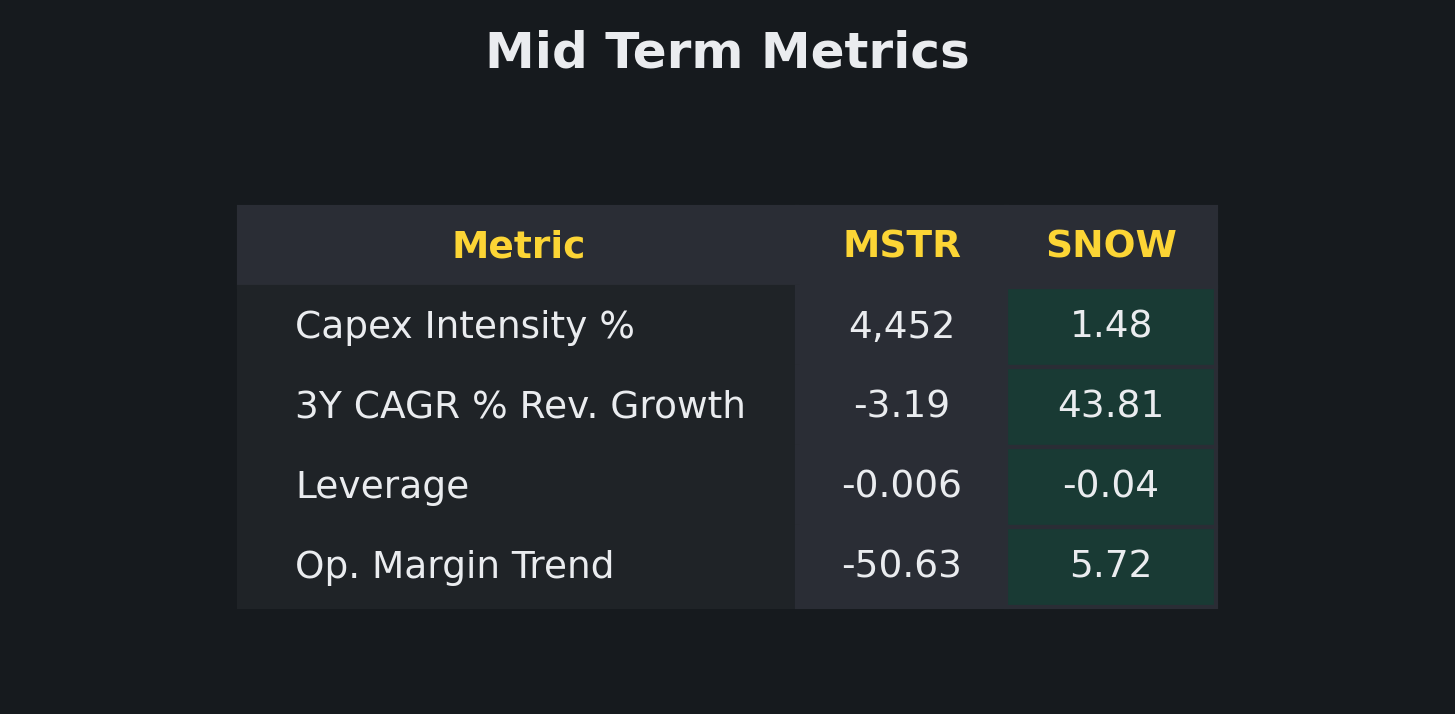

Mid-Term Muscle (6 Months - 3 Years):

When we look at the mid-term, SNOW pulls a clean sweep, winning all four metrics. This is pretty telling. SNOW is spending its capital much more efficiently (that’s Capex Intensity). Its revenue growth over the last three years has been robust at over 43%, while MSTR actually saw its revenues shrink by about 3%. SNOW also shows less Leverage, meaning it's in a more comfortable spot with its debt relative to its earnings. And importantly, SNOW's operating margin trend is positive, suggesting its core business is getting more profitable over time. MSTR, on the other hand, saw a significant negative trend here. This horizon really highlights SNOW’s strong operational performance and growth versus MSTR's software business, which appears to be struggling on these fundamental measures. MSTR's capex intensity was sky-high at over 4,000%, which is just an astronomical number, likely skewed by how its Bitcoin activities or relatively small software revenues impact these traditional calculations.

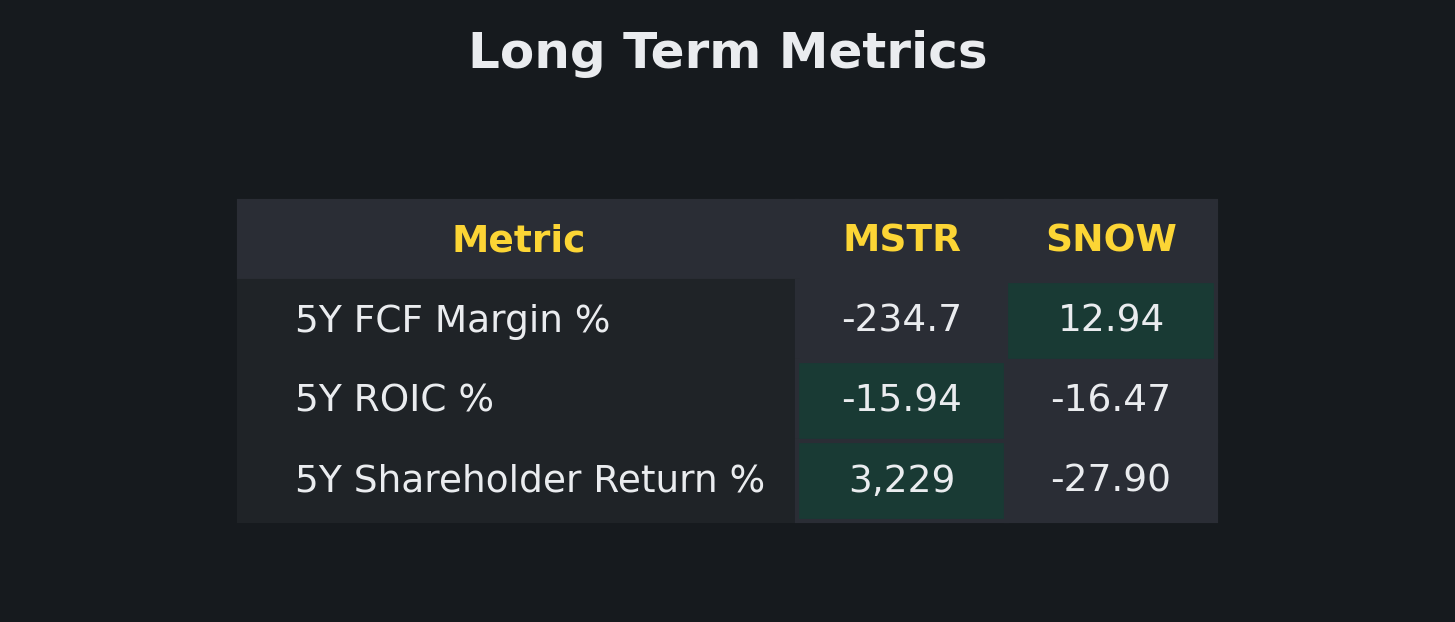

Long-Term Endurance (3+ Years):

Things get a bit more interesting in the long-term view. MSTR snags two wins here. Unsurprisingly, its 5-Year Shareholder Return is through the roof at over 3,200% – that’s the Bitcoin effect, loud and clear. MSTR also won on 5-Year Return on Invested Capital (ROIC). Now, both companies had negative ROIC, meaning neither was effectively generating profit from their capital over this period, but MSTR’s was less negative. SNOW took the win on 5-Year Free Cash Flow Margin. This is a big one – SNOW has been generating positive cash from its operations after covering its capital spending, which is a healthy sign. MSTR, in contrast, had a deeply negative FCF margin. So, while MSTR delivered huge returns (if you timed Bitcoin right), SNOW is showing better fundamental cash generation from its actual business.

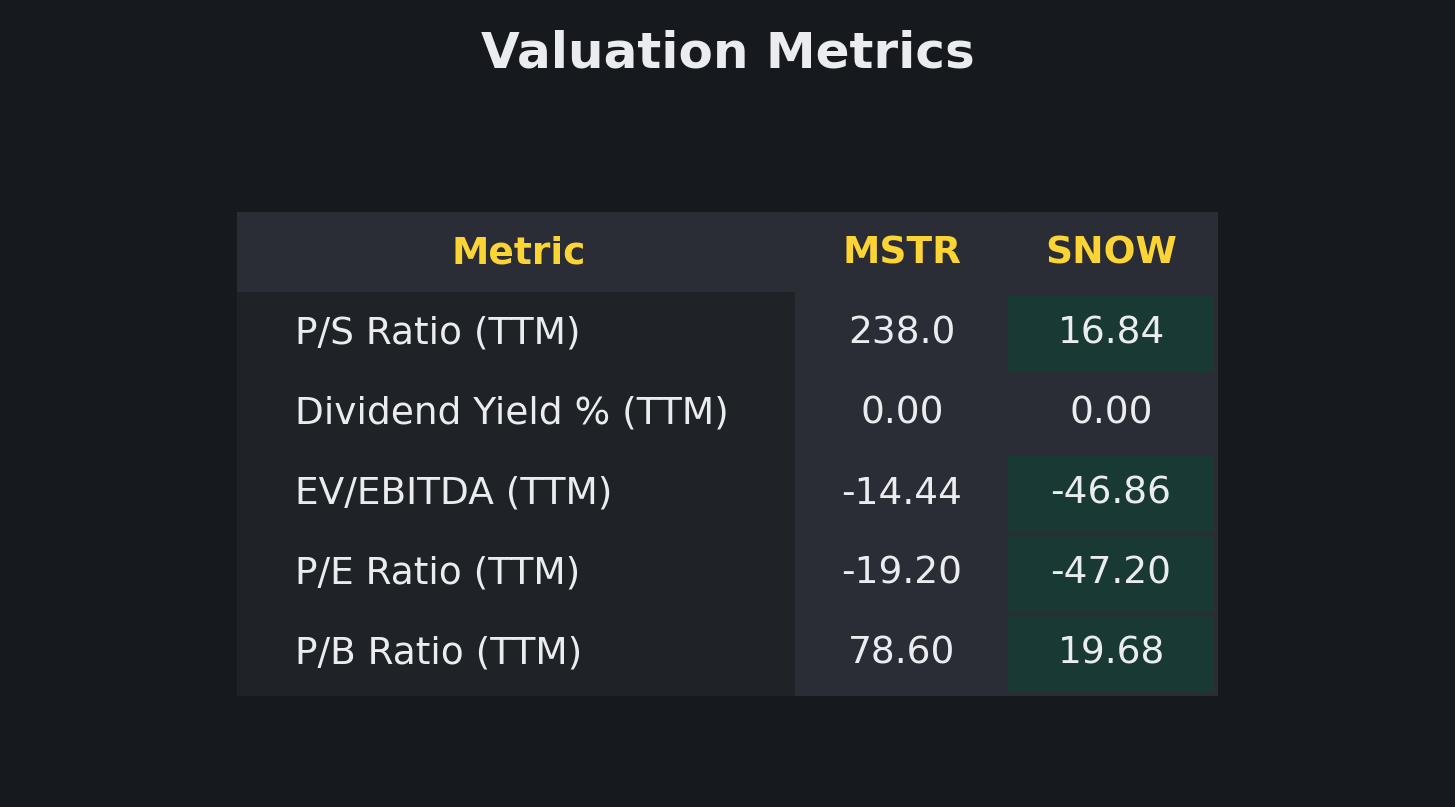

Valuation Check-Up (Right Now):

When we look at how these stocks are priced today, SNOW is the clear winner across most valuation metrics. It has a much lower Price-to-Sales (P/S) ratio, meaning you're paying less for each dollar of SNOW's sales compared to MSTR's. SNOW also "won" on Price-to-Earnings (P/E) and EV/EBITDA. I say "won" because both companies showed negative numbers here, indicating they weren't profitable by these trailing measures. However, the duel's "lower is better" rule means SNOW's more negative numbers technically won. Frankly, when both are negative, it’s more about who is less unprofitable, or if the metrics are even meaningful. MSTR's P/E was -19, while SNOW's was -47. SNOW also looked better on Price-to-Book (P/B). Neither company is paying a dividend, so that was a tie. Overall, SNOW appears to be less stretched in its valuation based on traditional metrics, while MSTR's figures are heavily influenced by its massive Bitcoin holdings relative to its software earnings.

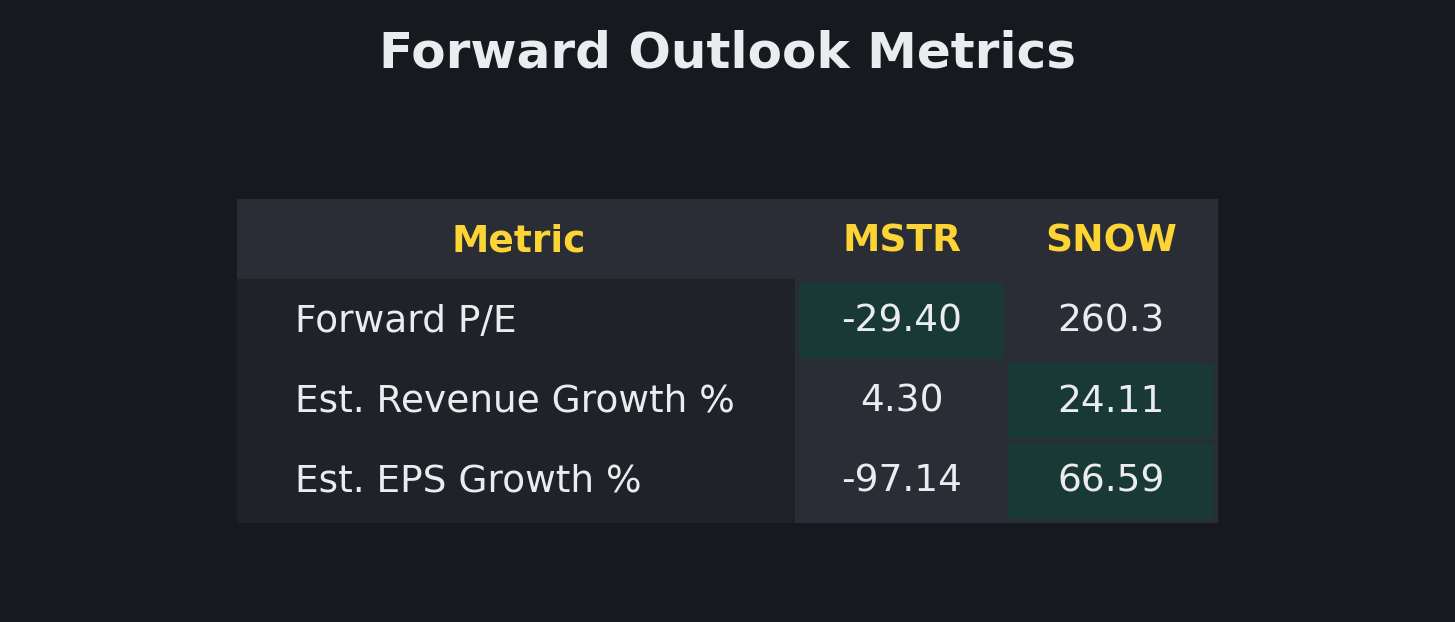

The Forward Look (1-2 Years Out):

Finally, peering into the future based on analyst estimates, SNOW again comes out largely on top. Analysts expect SNOW to grow its revenue significantly faster (24% for SNOW vs. 4% for MSTR) and see much stronger EPS (Earnings Per Share) growth (a whopping 66% for SNOW versus a scary -97% for MSTR). This suggests Wall Street believes SNOW's core business has a much stronger growth trajectory. MSTR did win on Forward P/E, but again, MSTR’s was negative (-29) while SNOW’s was a high positive (260). In this case, a less negative P/E is preferred by the "lower is better" rule over a very high positive P/E if the company is expected to be unprofitable. The key takeaway here is the stark difference in growth expectations for their underlying businesses.

🏆 The Verdict 🏆

Alright, after tallying up the scores from all five horizons, Snowflake (SNOW) is the Overall Winner of this NASDUCK Duel, taking four horizons to MSTR's one.

Here’s my take: Strategy (MSTR) is, for all intents and purposes, a leveraged bet on Bitcoin. The numbers show its core software business has been contracting and faces significant challenges in profitability and growth. If you’re a true Bitcoin believer and want that amplified exposure through a publicly traded company, MSTR certainly offers that. Its stock performance has been phenomenal, driven almost entirely by its crypto strategy. However, be prepared for extreme volatility and understand that the underlying software fundamentals, as per our duel metrics, look weak.

Snowflake (SNOW), on the other hand, is a pure-play leader in the booming AI Data Cloud market. The duel shows a company with strong, consistent growth in its core operations, improving profitability trends (on some measures), solid cash generation, and very positive analyst expectations for future growth. It’s operating in a hot sector with massive tailwinds. While its valuation metrics aren't exactly "cheap" in absolute terms, they appear more grounded in its business fundamentals compared to MSTR.

So, what does this mean for you?

If you're looking for a company with a strong, growing core business in the enterprise tech and AI space, Snowflake's numbers from this duel point in a clearer direction. Its success is tied to the continued adoption of cloud data analytics and AI, which looks like a pretty solid trend.

If your primary goal is to ride the Bitcoin wave, MSTR offers a unique, albeit risky, vehicle. Just be aware that the company's software segment doesn't seem to be pulling its weight based on these quantitative metrics.

As always, this duel is a quantitative snapshot. It’s based on historical data and analyst consensus, and it doesn’t dive into the qualitative stuff – management, competitive moats, the nitty-gritty of debt structures, or the full story behind those Bitcoin impairments. So, do your own homework, dig deeper, and figure out what fits your own investment strategy and risk appetite.

That’s all for this NASDUCK Duel. Until next time, invest wisely!

Breaking news : MSTR may be facing a class action lawsuit (misleading statements regarding its Bitcoin strategy and a 6B unrealized Q1 loss). Confirmed ?