Hey!

Today we’re looking at Pinduoduo PDD 0.00%↑ , the Chinese shopping app that turns bargain‑hunting into a group sport. Right now the shares are slumped near a one‑year low even though the business is pumping out cash like a slot machine stuck on “jackpot.” Add to that a fresh round of U.S.–China tariff cross‑fire that lands squarely on Temu’s doorstep. Let’s see what the numbers—and the politics—tell us.

If you prefer to listen, here’s a podcast about this article:

Quick Summary (TL;DR)

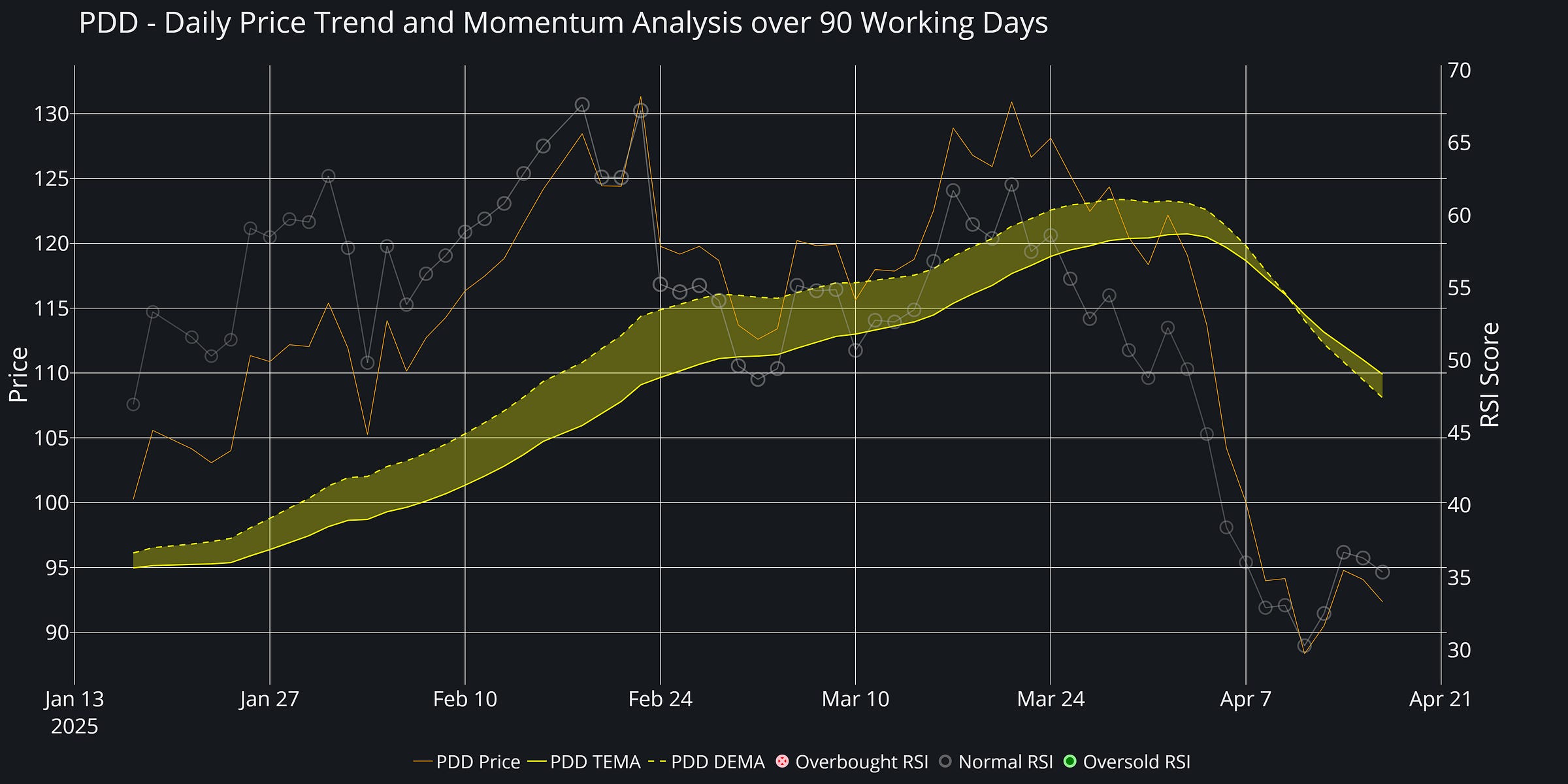

Price pain, profit gain – stock off ≈45 % from last summer while revenue and free cash flow hit new highs. 🟩

Balance sheet – mountains of cash, molehills of debt. 🟩🟩

Trade‑war wildcard – U.S. closes the de minimis loophole and slaps 145 % tariffs on Chinese goods; Temu will raise prices and margins take a hit. 🟨

Plan – I’m accumulating on weakness, looking for a multi‑month bounce back into the $140–150 zone. Trailing stop once the position is green.

Timeframe – give it 6‑12 months; patience required.

(Free readers get the high‑level view. Paid NASDUCKers, keep reading for the gritty details.)

Breaking Down the Business

Pinduoduo is the flea market gone digital: you rope in a few friends, click “Team‑Buy,” and everybody scores 30 % off a box of socks or a box of mangoes. That model let them conquer China’s smaller cities and farms where price rules. Lately they’ve taken the same playbook overseas with Temu, the ultra‑cheap app spamming every Instagram feed in America.

Why it matters: cheap goods + social sharing equals rocket‑fuel user growth… and fat margins because PDD doesn’t own warehouses. They just move pixels and payments.

(≈85 % of the article left)

Read on for bespoke graphs, detailed analysis, entry points, and the full trading plan.