Hey!

Today we're looking at Regeneron Pharmaceuticals, or REGN 0.00%↑ if you're looking at the ticker. Right now, they're in a bit of a tight spot – one of their biggest money-makers is taking a hit, and the stock's paid the price. Let's see what the numbers tell us about their chances for the long haul.

🎧 If you prefer to listen, scroll down to the Members section for a full podcast.

Quick Summary (TL;DR)

The stock's taken a beating because their big eye drug, EYLEA, is losing sales fast. This is the main drag.

But they've got a star player in Dupixent (for stuff like eczema and asthma) that's still growing strong, and a pipeline of other drugs that could be big if they get approved.

Financially, the company itself is solid as a rock. The big question is whether the new and growing drugs can make up for what EYLEA is losing.

My ratings on the key bits:

EYLEA Performance: 🟥 (Big trouble here, sales are falling fast)

Dupixent Growth: 🟩🟩 (Shining star, carrying a lot of weight)

Other Pipeline Drugs: 🟨 (Got potential, but gotta deliver – upcoming news is key)

Financial Health (Caesar Score 20): 🟩🟩 (Rock solid, plenty of cash, low debt)

Current Stock Valuation: 🟩 (Looks cheap if they can turn the ship and grow again)

Company Social Responsibility (ESG): 🟥 (Needs serious work, lagging peers)

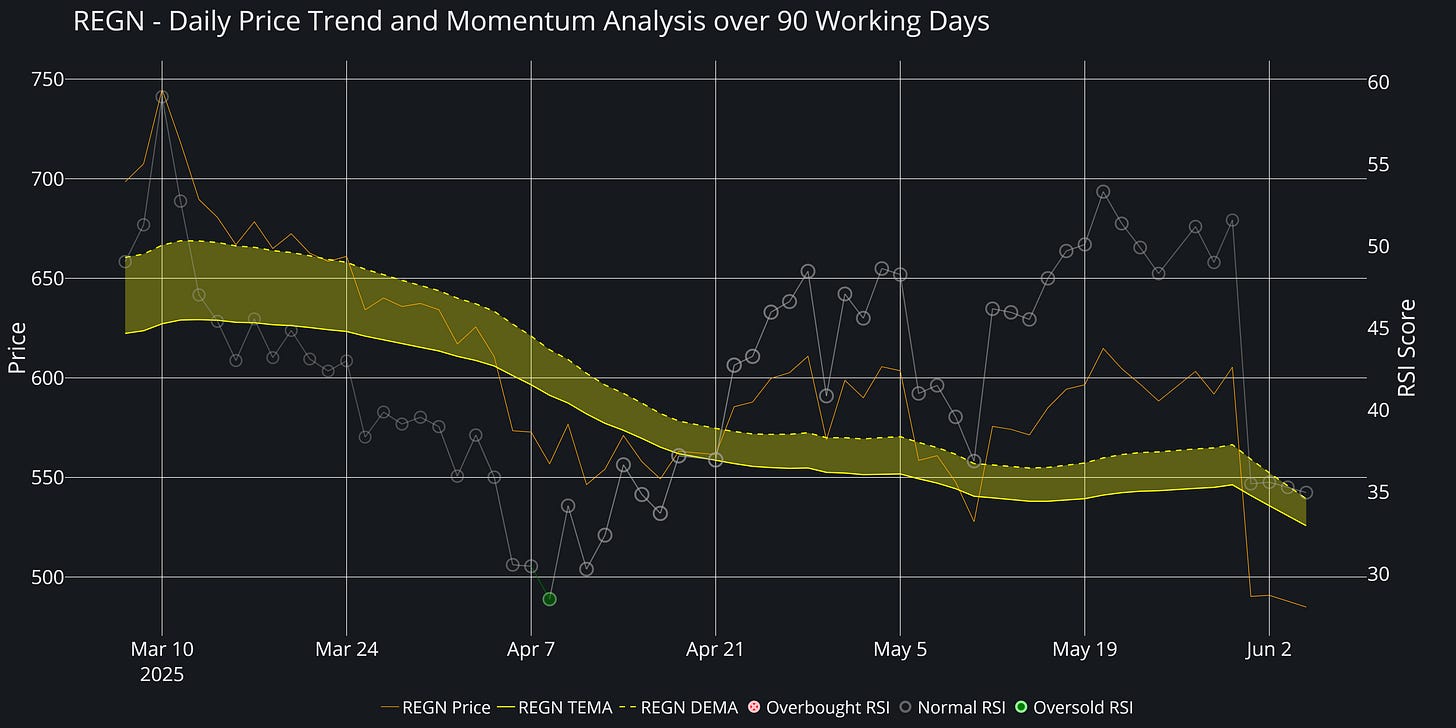

Short-Term Stock Trend: 🟥 (Heading down, sharply, but very oversold)

Breaking Down the Business

So, what does Regeneron actually do? Imagine scientists in a lab, super smart folks, trying to figure out how diseases work at a tiny, molecular level. That's Regeneron. They're famous for a couple of things: their 'Trap' technology, which sounds cool and actually led to their blockbuster eye drug EYLEA. And they have this VelociSuite thing – basically a high-tech system to discover new drugs faster.

They don't just discover them; they develop them, get them approved, and make them. They tackle tough areas:

Ophthalmology: That's eye stuff. EYLEA, for diseases like wet age-related macular degeneration that can steal your sight, was huge for them. This is where the current pain is.

Immunology: This is about your body's defense system. Their drug Dupixent helps people with conditions where the immune system goes haywire, like severe eczema or asthma. This one is doing great.

Oncology: Cancer. They're working on new ways to help your body fight tumors with drugs like Libtayo, and others are in the pipeline.

Rare Diseases: Conditions that don't affect a ton of people but are devastating for those who have them.

They do their own research and development (R&D), which costs a boatload of money, but they also team up with other big companies like Sanofi (for Dupixent) and Fujifilm. Sometimes they buy smaller companies or assets, like parts of 23andMe (the DNA testing company), to get new ideas for drugs. Right now, their main game plan is to use their pipeline of new drugs and their strong bank account to get through the EYLEA storm.

85% of the article left

Read on for my take on their numbers, what's coming next, and how I'm thinking about trading this one for the long term.