The #1 "Safe" Stock Mistake That Will Cost You Everything (And The 'Submarine' Stock I'm Buying With a 67% Profit Margin).

NASDUCK Free Sample

Like NASDUCK? Be sure to check out our other publications:

The Stock Archeologist, our stock forecasting system.

EuroMarket, where we talk about European stocks.

TradeWatch, Caesar’s intraday experiments.

This is a Free Sample of NASDUCK Weekly. Read the full post here.

Here’s a brief audio overview if you don’t feel like reading:

The jobs report was a pathetic 22,000. Wall Street threw a party.

That’s the only signal you need that it’s all good - for them. While the talking heads on television sold you a story about a “cooling economy,” the machines were translating Main Street’s pain into their next buy signal.

They need you to react. They need you to feel uncertain.

The Enemy is the Algorithm. The Weapon is the Scorecard.

The enemy isn’t a person in a suit. It’s the algorithm designed to make you sell when you should be buying. It’s the headline engineered for clicks, not conviction. It’s the entire financial media complex built to keep you emotional and one step behind.

I spent 20 years inside that machine. I saw the playbook. They create a narrative, trigger a herd mentality, and then collect the scraps after the stampede.

It’s why we built the Caesar Score. It’s not an algorithm. It’s an arsenal. A simple, ruthless system to score companies on what actually matters.

Here’s an example:

We don't guess. We score. We buy. We wait.

The Free Masterclass: An AI Behemoth Hiding in Plain Sight

Let’s put the system to work.

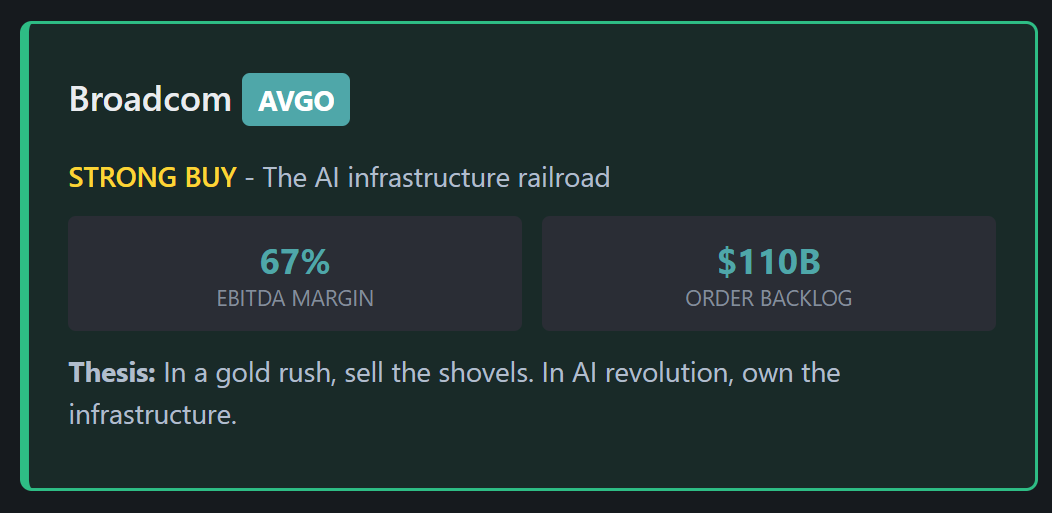

The Setup: Broadcom ($AVGO) doesn't just ride the AI wave. They build the damn infrastructure it runs on. Custom AI chips, critical software—they are the new digital railroad.

The Conflict: Wall Street sees a tech stock that’s had a big run and gets nervous. They see complexity. They hear whispers about a slowdown. They panic. Here's what they miss.

The Numbers That Matter:

Power: Broadcom prints money with a 67% EBITDA margin. For every dollar that comes in, 67 cents is pure operational profit. A fortress.

Price: They have a $110 BILLION backlog of confirmed orders, a guaranteed revenue stream. You’re paying for a locked-in future, and at a discount to the value they're creating.

The Verdict: STRONG BUY.

This isn’t a momentum trade. It’s buying a piece of the bedrock of the AI revolution while others are distracted by shiny objects.

In a gold rush, sell the shovels.

In a digital revolution, own the infrastructure.

From Battleship to Submarine

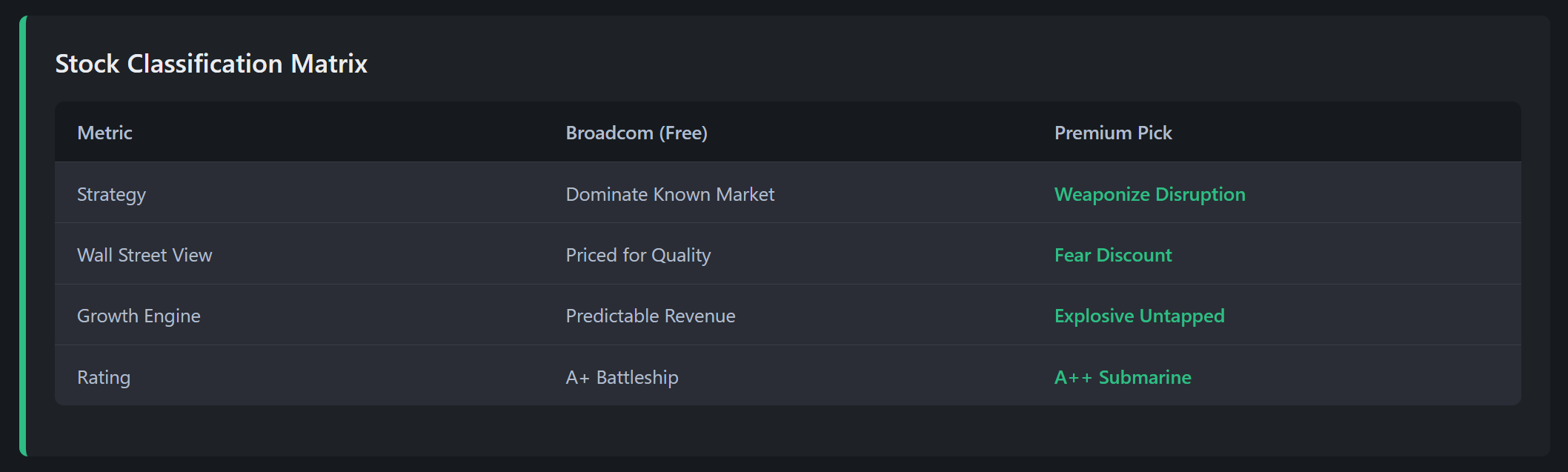

Broadcom is an A+ opportunity. A true battleship, built to weather any storm.

But it’s not the #1 pick I just sent my members.

The stock I've reserved for them is an entirely different class of operator. Broadcom is a battleship, powerful and obvious. This new pick is a submarine. It thrives in the chaos that sends other ships to the bottom. It uses market turmoil as cover.

Wall Street has left it for dead, trading it sideways for months. They’re bored. Their boredom is our entry point.

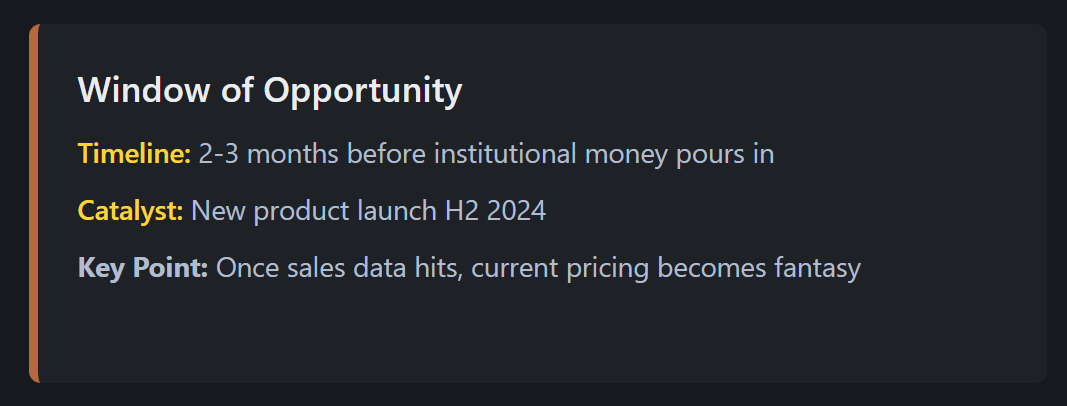

This kind of disconnect rarely lasts. My #1 pick is launching a new, market-defining product in the second half of this year.

Once that sales data hits the street next quarter, the "asleep at the wheel" price is gone. Forever. The institutional money will pour in, and the entry point we’re looking at right now will look like a fantasy.

They panicked. We have 2-3 months to capitalize on it.

Your New Arsenal

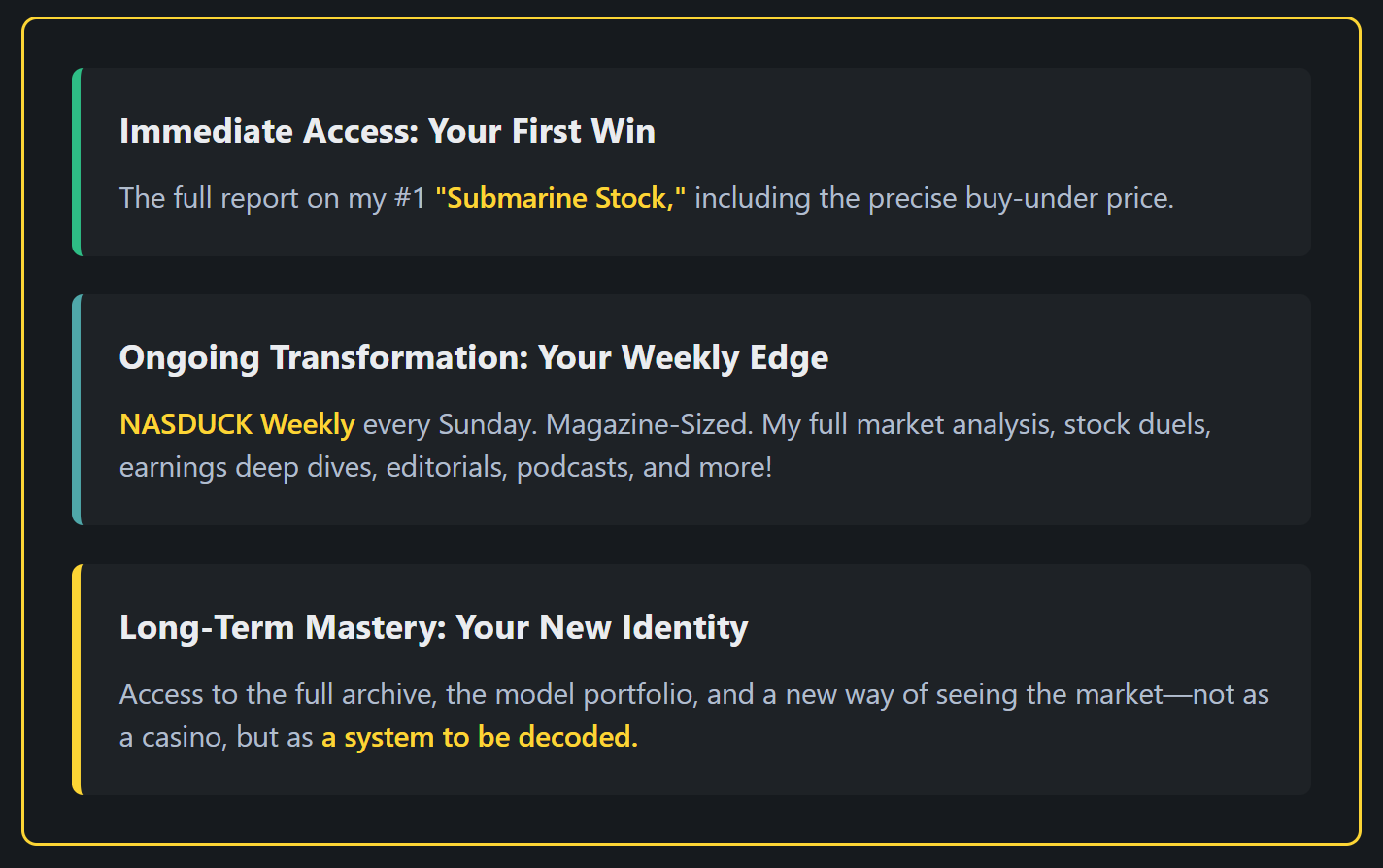

Subscribing isn't about getting one stock tip. It's about acquiring a system.

The Choice Is About Your Identity

You can keep sitting on the sidelines, trying to piece together conflicting headlines from cable news, feeling like you're always reacting, always a step behind.

Or you can decide today to operate with a clear, systematic edge.

At the end of the day, it’s not about a single stock pick. Ask yourself: who do you want to be as an investor five years from now?