🔸 Three "Set It & Forget It" Portfolios for The Crazy Times

Three NASDUCK Portfolios, 30 Assets Each

Hey!

Today's a big one. We're pulling back the curtain on something I've been working on – refining the NASDUCK approach for the choppy waters we're navigating. The original NASDUCK30 has been a solid performer, no doubt about it, but the world changes. Smart investors adapt.

So, now I've put together three distinct NASDUCK portfolios. Think of them as different tools for different jobs, or maybe different flavors depending on your appetite for risk right now.

How It’s Going

Things have been... interesting out there. We had that post-COVID boom, then the inflation nightmare of '22, the AI surge, and now we're dealing with Trump's second term – tariffs, trade talk, the whole nine yards. The market's been a roller coaster, and frankly, a simple "buy the index" approach hasn't cut it if you wanted real growth.

You know the NASDUCK30 portfolio I've been running. It was built for growth, pure and simple. And let me tell you, it delivered. From the start of 2021 through this April, while the S&P 500 ground out about 11% per year, the original NASDUCK30 absolutely smoked it, clocking in at over 48% per year. Yeah, you read that right. Turning $10k into nearly $55k while the index barely got you to $16k. That's finding winners.

Different Markets Need Different Strategies

Some folks just sleep better knowing their portfolio is built to handle specific kinds of turbulence. What crushed it yesterday might just tread water today.

So, I didn't just sit on my hands. I developed two new variations alongside the original:

NASDUCK30AG (Aggressive): This one's built differently. It’s designed for times like now – volatile, uncertain, maybe a little scary. Think "America First" winners, defense, stuff that works when tariffs are flying and things are getting reshored. It's for those feeling fearful but still wanting to stay in the game smartly.

NASDUCK30EQ (Equilibrium): This is the middle ground. It keeps a good chunk of that growth engine from the original NASDUCK30 but mixes in some different ingredients – specifically, a dose of crypto assets and more gold. It's trying to balance that upside potential with a bit more diversification. This is the portfolio I'll be running personally starting this January.

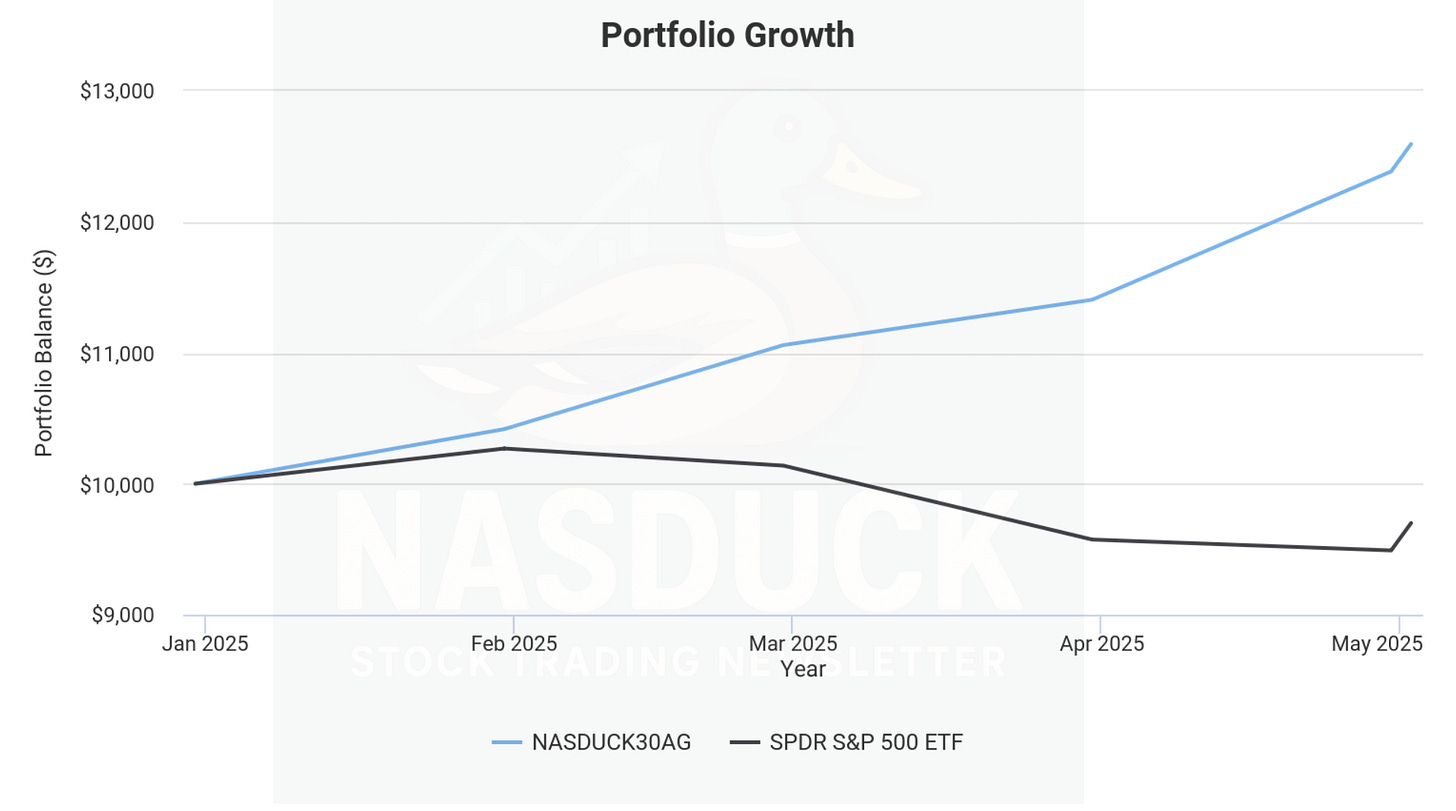

Now, why am I telling you this? Because the game changed this year. Remember how NASDUCK30 was the king long-term? Well, guess what happened in the first four months of 2025, with all the new Trump administration noise?

The S&P 500 lost 5.1%.

The original NASDUCK30 was basically flat (+1.7%).

But that NASDUCK30AG – the one designed for this environment? It rocketed up 23.8%.

See? Different tools for different times.

Knowing which portfolio is built for what, understanding the guts – the holdings, the risks, the why behind each one – that's crucial. It's the difference between guessing and investing with a plan.

And that detailed breakdown? That's for my NASDUCK members.

If you want the full analysis – the deep dive into each portfolio, the specific metrics, the thinking behind the stock picks, and the links to see the holdings yourself – you need to be a member. We'll look at how they handled the boom, the bust, and this new Trump era. We'll talk volatility, drawdowns, and exactly why I'm shifting my own focus to the NASDUCK30EQ.

Understand the engine under the hood so you can navigate what's coming.

Ready for the real deal? Upgrade below (unless you’re already a Member). It's worth every penny if you're serious about your money in these markets.