Warning: These 2 "Must-Own" Tech Giants Are Now a Strong Sell as EPS Is Forecast to Plummet 65%

NASDUCK Weekly

🎧 If you prefer to listen, here’s a free podcast!

NASDAQ-100 Report

Hey!

Markets hit new all-time highs this week. The Dow crossed 47,000, the S&P and Nasdaq followed. Two forces drove the rally:

1. Good inflation news. September CPI came in cooler than expected, giving the Fed room to cut rates. The 10-year Treasury yield eased to 4.00%. Lower yields make future profits more valuable today, pushing stocks higher.

2. Better-than-feared earnings. Old-economy names like Ford and Caterpillar showed strength. Tech was mixed but held up enough to support the move.

But watch this risk: Crude oil spiked 7% after U.S. sanctions hit Russian energy. Biggest weekly jump since June. Higher energy prices fuel inflation and kill consumer spending.

Sector Performance:

🟩🟩 Energy (+2.9%): Led after Russian sanctions sent crude soaring.

🟩 Consumer Discretionary (+2.4%): Strong automaker earnings.

🟩 Communication Services (+1.2%): Resilient despite mixed results.

🟨 Tech: Held up well, mixed beneath the surface.

🟥 Consumer Staples (-0.5%): Lagged.

🟥 Materials (-0.8%): Trailed.

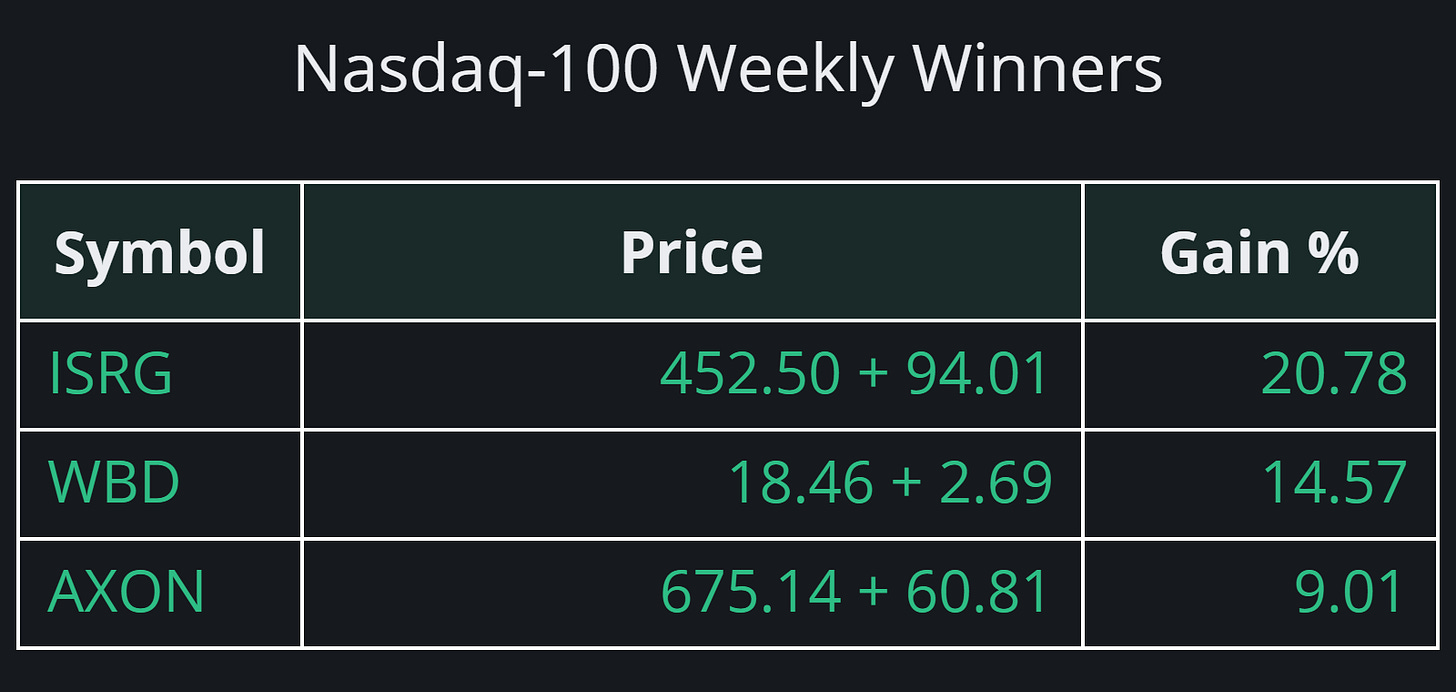

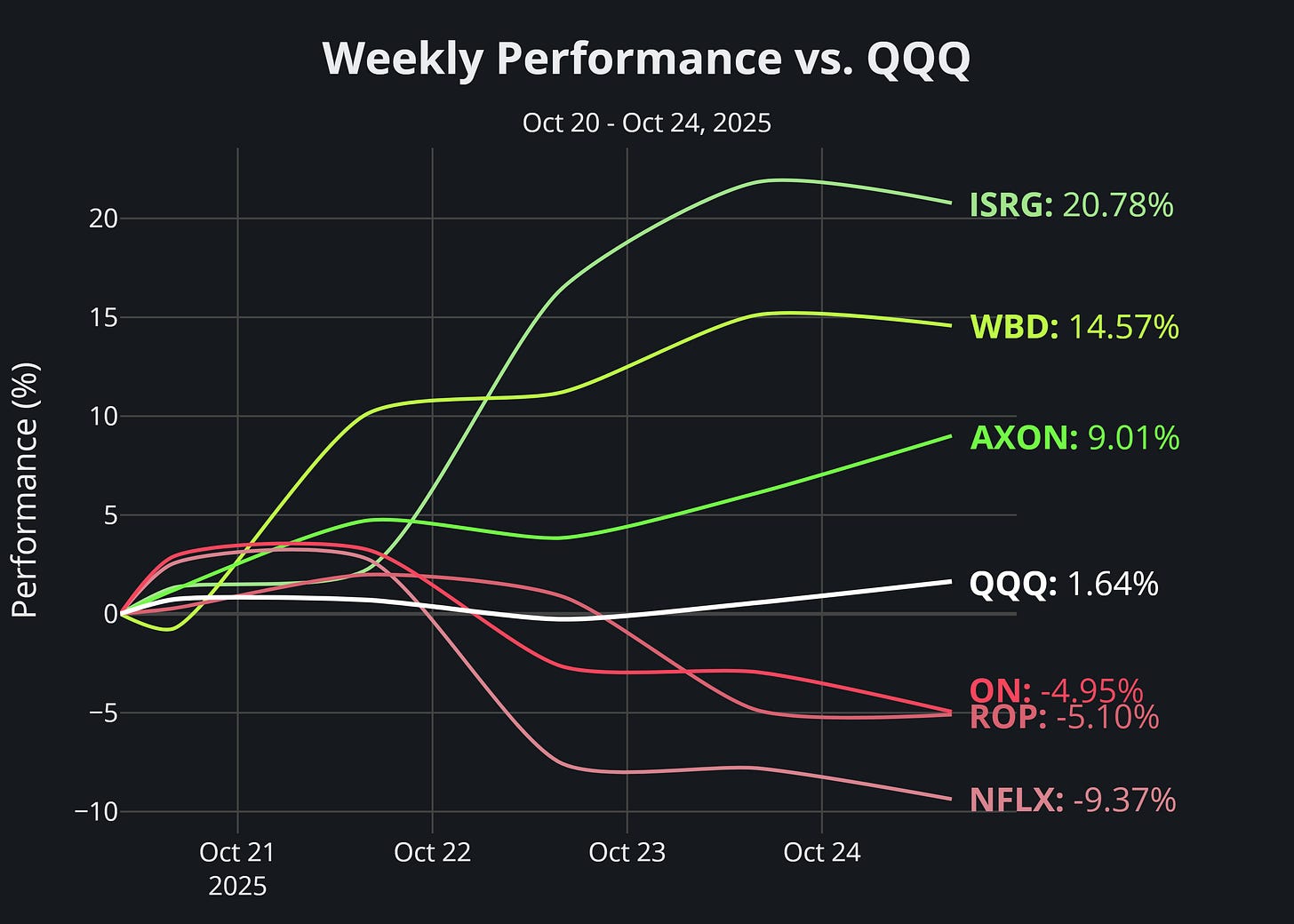

Winners and Losers

Intuitive Surgical ISRG 0.00%↑ demolished earnings. Revenue up 23%, raised da Vinci robot procedure forecasts. Pure business strength.

Warner Bros. Discovery WBD 0.00%↑ exploring sale after “unsolicited interest.” Reports of a rejected $60B offer fueled buyout speculation.

Axon Enterprise AXON 0.00%↑ climbed on positive analyst coverage and growing anticipation for Nov 4th earnings. Technical strength building.

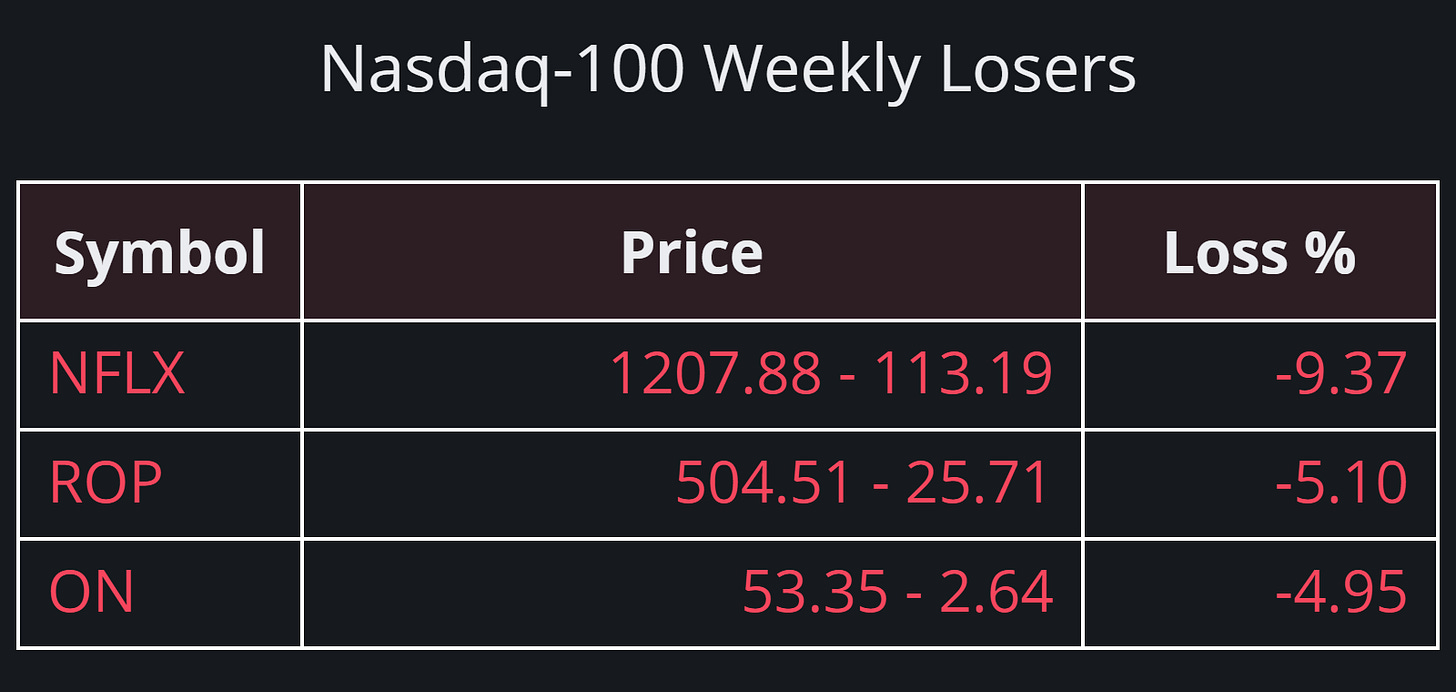

Netflix NFLX 0.00%↑ fell despite record revenue. A surprise $619M Brazil tax expense crushed margins and spooked investors.

Roper Technologies ROP 0.00%↑ posted solid results and announced $3B buyback, but slightly lowered guidance. That’s all it took.

onsemi ON 0.00%↑ had no bad news. But Texas Instruments gave weak outlook, dragging down the whole chip sector in sympathy.

Looking Ahead

Next week might be the most critical of the quarter:

Fed Decision (Oct 28-29): Quarter-point cut expected. Powell’s press conference sets the direction into year-end.

Major Economic Data: Q3 GDP Thursday, PCE inflation Friday. These can completely change the narrative.

Big Tech Earnings: Microsoft, Alphabet, Meta (Wednesday), then Apple and Amazon (Thursday). These five giants can single-handedly move the entire Nasdaq-100.

Expect volatility. Be cautious. These events could trigger sharp swings either way. Energy remains sensitive to sanctions and geopolitical headlines.

Nasdaq-100 Forecast for Next Week

[This analysis is available in the PAID section]

All this goodness won’t fit in your inbox. Read all of it on our Substack.

EARNINGS VS. REALITY

BKR 0.00%↑ Baker Hughes: The Two-Speed Transformation

Baker Hughes posted solid numbers, but you’re looking at two completely different businesses under one roof. Their Industrial & Energy Technology (IET) segment—serving LNG and AI data centers—is on fire. The traditional Oilfield Services business? Facing a brutal environment.

IET just booked $4.1 billion in new orders, bringing backlog over $32 billion. That’s years of locked-in revenue.

The stock already trades at a 27% premium to its sector.

Piotroski Score of 7/9 confirms fundamentals are healthy.

What Wall Street is missing:

Management is deliberately pivoting from oil services to high-tech industrial. Every other word on the call was LNG, data centers, AI. They’re managing the old business for cash, not growth, while pouring resources into the future.

Is this transformation real, or just another corporate rebranding? The IET backlog suggests it’s real. But can they execute while the oil side declines?

[Full Caesar Score breakdown, verdict, and price targets in PAID section]

INTC 0.00%↑ Intel: Selling a Dream, Facing a Nightmare

Intel wants you to believe the turnaround is in full swing. They beat Q3, raised $20B, partnered with NVIDIA, and won’t shut up about their Foundry business being “essential for AI.”

Where it falls apart:

Q4 guidance is a disaster.

Revenue falling, gross margins collapsing 3.5 percentage points,

EPS plummeting 65%.

The Foundry loses 55 cents for every dollar of revenue.

The stock trades at a P/E of 870. Not a typo.

Read between the lines: That $20B was a lifeline. The NVIDIA partnership is an admission they can’t compete in high-end AI chips. Worst of all, the CFO admitted manufacturing yields on next-gen chips won’t deliver decent profits until late 2026.

Is this a strategic turnaround or a slow-motion collapse dressed up in AI buzzwords?

[Full analysis, Caesar Score, and verdict in PAID section]

LRCX 0.00%↑ Lam Research: The AI Gold Rush Shovel Seller

Lam delivered a monster quarter: record revenue, record gross margin, record operating margin. They’re perfectly positioned at the heart of the AI boom, making the equipment that manufactures the world’s most advanced chips.

The financials are rock-solid:

Caesar Score of 16,

Piotroski of 8,

Altman Z-Score of 14 (zero distress).

They’re a cash-generating machine. P/E of 33 versus sector average of 58.5. You’re getting top-tier quality without paying a ridiculous premium.

Management handled the China restrictions masterfully—quantified the impact (manageable) and their guidance implies the rest of the business is growing so fast it’s almost completely offsetting the China headwind.

The question: Are they trading margin for long-term stability, or is this growth sustainable?

[Full verdict and strategic analysis in PAID section]

NFLX 0.00%↑ Netflix: The New Entertainment Powerhouse

The quarter looked messy—EPS miss that sent the stock down 9.4%. But that was a one-time Brazil tax charge covering multiple years. Strip that out and the core business is firing on all cylinders.

The real story:

Their ad-supported tier is on track to double revenue this year.

Engagement at all-time highs.

Operating margin near 30% (elite).

Altman Z-Score of 12.47 (fortress balance sheet).

P/E of 44.7 is right in line with sector average—you’re not overpaying.

It’s about advertising, live events, games, and merchandise. They’re transforming from a streaming service into a diversified entertainment empire.

Is this one-time tax issue a buying opportunity, or are there more Brazil-style surprises lurking in their international expansion?

[Complete business breakdown and trading strategy in PAID section]

TSLA 0.00%↑ Tesla: Science Fiction vs. Financial Fact

The earnings call was pure science fiction. Elon barely mentioned cars. It was all Full Self-Driving, humanoid robots, and robotaxis. He called the Optimus robot an “infinite money glitch” and painted a picture of Tesla as the biggest AI player on Earth.

The financial reality:

Caesar Score rated them “Poor” and “severely overvalued.” They missed earnings. Operating margin is a mediocre 7.5%—car manufacturer numbers, not AI company numbers. P/E ratio of 263, which is 3.4x the sector average.

The frantic pivot to robots and AI is desperation. The core auto business can’t justify this valuation. The whole bull case rests on delivering multiple moonshots flawlessly, something they’ve struggled with before.

Are you buying a car company, or making a venture capital bet on unproven technology?

[Full risk analysis and verdict in PAID section]

TXN 0.00%↑ Texas Instruments: A Great Company in a Tough Spot

TXN reported solid results but gave guidance that matters more: semiconductor recovery is happening much slower than expected. They’re cutting factory production to prevent inventory buildup.

The numbers tell the story: Revenue dropping next quarter, but earnings falling twice as fast. They’re deliberately crushing gross margins by slowing factories. Balance sheet is a fortress (Altman Z-Score 8.69), but they’re spending more on capex and buybacks than they’re generating in free cash flow.

Management is asking for patience—look past the next few ugly quarters toward long-term free cash flow generation. They’re planning to break out “data center” as a new business segment, showing where future growth lives.

Is this temporary pain before recovery, or the start of a longer semiconductor downturn?

[Full Caesar Score and timing strategy in PAID section]

HON 0.00%↑ Honeywell: The Smart Industrial Slim-Down

Honeywell beat earnings and sales, raising full-year guidance for the third time. But the real story is the massive transformation: spinning off two major divisions (including Aerospace) to become a company purely focused on high-growth automation.

The numbers are excellent:

Caesar Score of 15.

P/E of 22.4 versus sector average of 41.4—you’re getting quality at a discount.

Operating margin of 21.6%.

Order growth was a massive 22%, pointing to strong future revenue.

Management is playing chess: guiding for “transitory” margin pressure next year while building a huge order backlog. The strategy is designed to set up 2026 as a massive year of margin expansion, right after spin-offs complete. They also signaled they’ll cash in their Quantinuum quantum computing stake—potential windfall for shareholders.

Is this value-unlocking transformation going to pay off, or create execution risk during the separation?

[Full breakdown and verdict in PAID section]

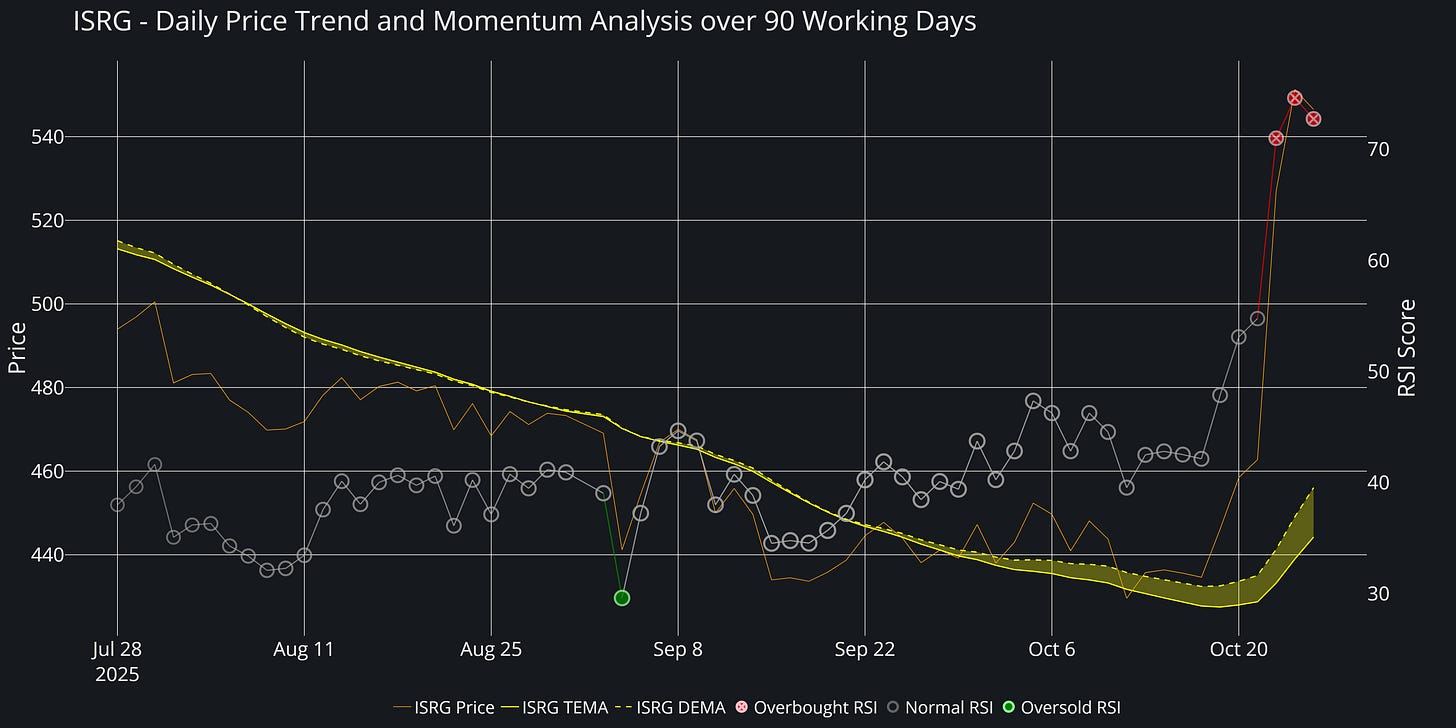

ISRG 0.00%↑ Intuitive Surgical: A Flawless Operation

Intuitive knocked it out of the park: revenue up 23%, procedures up 20%. The new da Vinci V robot is a massive hit driving upgrades globally.

The company is a fortress: Incredible operating leverage (revenues growing 2x faster than expenses). 75% of revenue is recurring from instruments and services—highly predictable. The catch? P/E over 70. The stock is priced for perfection.

The most interesting strategic move: selling refurbished older robots. Brilliant defensive play—lets them compete at lower price points, protecting market share from emerging competitors while expanding to smaller hospitals that couldn’t afford new machines.

The question: Is this a world-class business at a dangerous entry point, or your last chance before the next leg up?

[Full valuation analysis and entry strategy in PAID section]

ORLY 0.00%↑ O’Reilly Automotive: The All-Weather Engine

O’Reilly delivered another solid quarter, sales up 5.6%. The split is telling: professional mechanic sales booming (10%+ growth), but DIY customer traffic slowing.

The financials are beautiful:

Caesar Score of 17 (”Excellent”).

Negative working capital—they sell parts and collect cash before paying suppliers. Essentially getting paid to hold inventory.

Trades at a significant discount to sector P/E.

The DIY weakness shows consumers are financially pinched. But O’Reilly’s professional strength shows they’re taking market share from weaker competitors. Their decision to accelerate new store openings (including Canada expansion) signals massive management confidence.

Is this a recession-resistant play or vulnerable if the consumer breaks completely?

[Full analysis and verdict in PAID section]

PCAR 0.00%↑ Paccar: Buying at the Bottom of the Hill

Paccar missed earnings slightly. Truck profit margins getting squeezed. The entire call focused on one thing: a new Section 232 rule change that will significantly lower tariff costs on steel and aluminum.

The numbers show the tariff pain:

Strip out their profitable Parts division, and truck gross margin is a weak 6.6%.

P/E of 19.6 is less than half the sector average—stock looks cheap if profits are about to turn.

Management is sending a crystal-clear signal: guiding margins down a bit more next quarter, repeatedly saying tariff costs are “peaking in October.” They’re telling the market Q4 is the bottom. The new rule levels the playing field—they can either cut prices to gain share or hold steady and enjoy healthier margins.

Is this a classic cyclical bottom buy, or a value trap if demand softens further?

[Full verdict and price targets in PAID section]

ROP 0.00%↑ Roper Technologies: A Cash Cow with a Temporary Cough

Roper posted strong numbers (14% revenue growth) but trimmed guidance slightly. Management blamed a government shutdown delaying contracts and a copper tariff causing order delays.

Despite the trim, health is elite:

Caesar Score of 17,

Piotroski of 7.

The key metric is cash flow—they convert an incredible 32% of revenue directly into free cash.

Operating margin of 30% (world-class).

Balance sheet gives them $5 billion in M&A firepower.

Management is framing headwinds as “temporary timing issues,” not fundamental problems. Most interesting: their first-ever share buyback program. Confidence signal, or hint that finding perfect acquisitions at the right price is getting harder?

The question: Is this a buying opportunity on temporary weakness, or a warning that their acquisition strategy is hitting limits?

[Full analysis in PAID section]

TMUS 0.00%↑ T-Mobile: The Undisputed Champion

T-Mobile delivered a spectacular quarter: company records for customer growth (1M+ new postpaid phone subscribers), lowest industry churn, service revenue up 12%. They raised guidance across the board.

The numbers are fantastic:

Caesar Score of 15 (”Excellent”),

Piotroski of 6.

The valuation story is wild: P/E of 20.6 versus sector average of 45.

The market hasn’t fully priced in their dominant position.

Beat earnings estimates by 8%.

Management’s strategy is simple and powerful: 70 million AT&T and Verizon customers still mistakenly believe competitors have better networks. Their entire focus is closing this “perception gap” with superior 5G and better digital experience. Incoming CEO is signaling he’ll raise long-term guidance—huge confidence signal.

How much more market share can they realistically take before hitting saturation?

[Full verdict and why this is a Strong Buy in PAID section]

NASDUCK DUEL: Roper vs. Tyler Technologies

We’re putting two serious software compounders in the ring: Roper Technologies ( ROP 0.00%↑ ) and Tyler Technologies ( TYL 0.00%↑ ).

They’re steady growers that acquire great businesses. Both make money from recurring software and services—predictable cash.

Roper is like a mini-Berkshire for niche software. Diverse portfolio serving insurance, legal, healthcare, and more.

Tyler is a specialist—the top dog in U.S. public sector software. They run state and local governments’ essential systems (courts, public safety, taxes). Sticky customers because switching is a nightmare.

Recently both stocks took a hit. Perfect time to see which offers the better opportunity.

Here’s what the numbers show:

Near-term: Tyler is slightly stronger—better earnings surprises, held up better over six months.

Medium-term: Dead heat. Roper growing sales faster and more capital-efficient. Tyler managing margins better and carrying almost no debt.

Long-term: Tyler edges ahead—better five-year shareholder returns, more effective at turning investments into profits. But Roper is an absolute cash-generating machine.

Valuation: Roper wins decisively. By every measure, you’re paying significantly less. Tyler is expensive—priced for perfection.

Analyst Expectations: Wall Street betting on Tyler for faster growth. But even with that, Roper still looks cheaper on forward earnings.

The Verdict:

These are two different ways to invest in the same idea: high-quality, recurring-revenue software.

Want a diversified, durable core holding that spreads risk across industries? Roper is your play. Proven operator, fantastic model, trading at a much more reasonable price. You can own it through any economic weather.

Want a pure, focused bet on the incredible stability of government spending? Tyler is the choice. Long contracts, sticky customers, clear path to improving profitability. But you pay a premium for that visibility and concentrate risk in one sector.

[Complete financial breakdown and detailed recommendation in PAID section]

RICK’S HOT TAKE: When Markets Hit Records While the Government Stayed Shut

The Week of October 20-24, 2025: When Nothing Made Sense Anymore

The S&P pushed past 6,738, the Dow kissed 47,000, everyone threw confetti—while the federal government was in its third week of shutdown. No jobs data. No economic reports. Just vibes and earnings calls and everyone flying completely blind.

Time to get real.

Markets don’t care about democracy. They care about liquidity, interest rates, and whether corporations keep inflating their numbers. This week proved it again: political dysfunction is just background noise when the money printer’s running and earnings mostly beat.

But beneath that euphoric surface, some genuinely contentious battles were playing out. Is this whole rally built on quicksand?

The China Trade War Goes Nuclear (Sort Of)

China threatened to cut off rare earth exports—those 17 elements you’ve never heard of that go into everything from iPhones to F-35 fighters. They control 70% of mining, 90% of refining, 93% of finished product. Monopoly built over decades while we outsourced.

Trump threatened 100% tariffs effective November 1st. Cleveland-Cliffs (the steel company) suddenly announced they’re pivoting to rare earth mining in Michigan and Minnesota. Stock popped 20-25%. USA Rare Earth jumped 41% in one day.

This is about who controls the physical infrastructure of modern technology. But here’s where I get cynical—Cleveland-Cliffs missed revenue badly in Q3, posted a per-share loss, and their CEO is suddenly a rare earth mining expert? Wells Fargo downgraded immediately.

Reddit went 95/100 bullish—”once in a generation,” “national security play.” Meanwhile, professional traders I know? 60-40 bearish. They see pump-and-dump theater wrapped in a flag.

Trump meets Xi on October 31st. Treasury Secretary already signaled de-escalation. This is negotiating theater. If they cut a deal, rare earth stocks crater 30-50% when the premium evaporates.

[Complete analysis of the trade war dynamics, Tesla’s profit problem, and what Bank of America’s bear market warnings actually mean in PAID section]

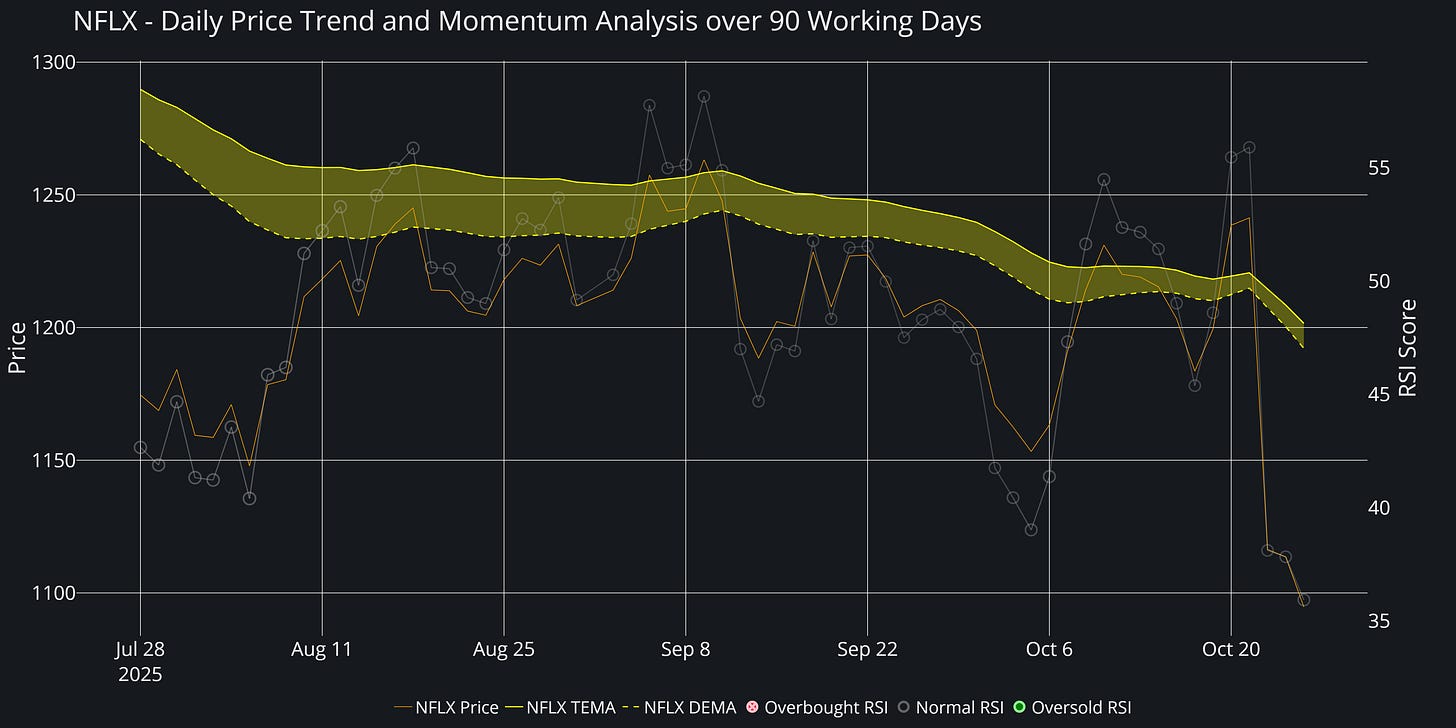

LONG-TERM ANALYSIS: Netflix Deep Dive

Netflix $NFLX: Wall Street Got Spooked by a One-Time Tax Bill. This Is Our Chance to Buy a Titan on Sale.

The market punished Netflix for a surprise Brazil tax issue, ignoring record revenue and massive growth in new businesses. Classic short-term overreaction. We’re looking at the long-term picture, and it looks damn good.

Quick Summary:

The Business: 🟩🟩

The Numbers: 🟩

Growth: 🟩🟩

Competition: 🟩

Future & Risks: 🟨

Netflix isn’t just a binge-watching app anymore. It’s the new global television network building three powerful money engines:

Subscriptions (foundation)

Advertising (the growth rocket—94M people on ad plan)

Live Events (the future—NFL and WWE creating appointment viewing)

Wall Street got hung up on a $619M Brazil tax charge. That’s noise. Operating profit margin is 26.7%. They expect $9 billion in pure cash after all bills this year. Debt-to-Equity of 0.67 versus sector average of 1.08. Caesar Score of 12 (solid 🟩 Good).

The old story was subscriber growth. The new story is live sports. Getting NFL and WWE transforms them from a content library into a live cultural hub. Revenue guided to grow 16% this year to over $45 billion.

The streaming wars are over. Netflix won.

The market is focused on a past problem (tax bill) while ignoring massive future growth engines (ads and sports). This is the kind of inefficiency we can exploit.

[Complete business breakdown, competitive analysis, growth projections, full trading strategy with entry points, stop-loss levels, and risk management in PAID section]

LONG-TERM ANALYSIS: Intuitive Surgical Deep Dive

Intuitive Surgical $ISRG: The King of Robotic Surgery Is Priced for Perfection. Here’s Our Move.

Intuitive just posted another monster quarter, and the stock is flying high. But with big-money competitors finally waking up, the question is simple: Did we miss the boat, or is this our chance to get in before the next leg up?

Quick Summary:

The Business: 🟩🟩 Undisputed leader in a market they created. Wide, deep moat.

The Numbers: 🟩 Revenue and procedures growing like a weed, sitting on a cash mountain with zero debt.

The Growth: 🟩🟩 New da Vinci 5 is a hit. Ion lung system on fire.

The Competition: 🟨 Giants are coming but years behind. One-horse race for now.

The Price Tag: 🟥 This is the main problem. Stock is incredibly expensive.

They make the da Vinci robot that gives surgeons superpowers. Classic razor-and-blades model: sell the multi-million dollar robot (razor), then hospitals buy disposable instruments and service contracts for every surgery (blades). Beautiful recurring revenue stream.

Latest quarter was a blowout: $2.51B revenue (23% jump), surgeries up 20%. Non-GAAP gross margin around 67%—immense pricing power. $8.43B cash, zero debt. Financial fortress.

Caesar Score is 7/20 (🟨), which sounds low. But it’s being dragged down by one thing: valuation. Stock at 70x earnings, more than double sector average. Wall Street already baked in years of success.

The new da Vinci 5 is driving accelerating growth. Ion lung robot procedures up an incredible 52%. They have 10,000+ robots installed worldwide and decades of surgeon training. A doctor who’s done 1,000 da Vinci surgeries won’t switch for a small discount.

The risk: Stock price reflects perfection. One imperfect quarter gets hammered. Competition will eventually figure it out.

[Complete competitive analysis, future outlook, Caesar Score breakdown, final verdict (BUY), and detailed phased entry strategy with three specific price targets in PAID section]

Disclaimer: Everything I write reflects my personal research and opinions. I aim to be accurate, but I can make mistakes. This isn’t financial advice. Markets are unpredictable—always do your own research and consider your personal situation before investing. Past performance doesn’t guarantee future results. The stock market involves risk, and you can lose money.

Keep reading with a 7-day free trial

Subscribe to NASDUCK to keep reading this post and get 7 days of free access to the full post archives.