WBD Long-Term Analysis

(Updated on 19 August 2024)

Hollywood's Next Blockbuster or Box Office Bomb?

Warner Bros. Discovery's financials read like a script for a high-stakes thriller.

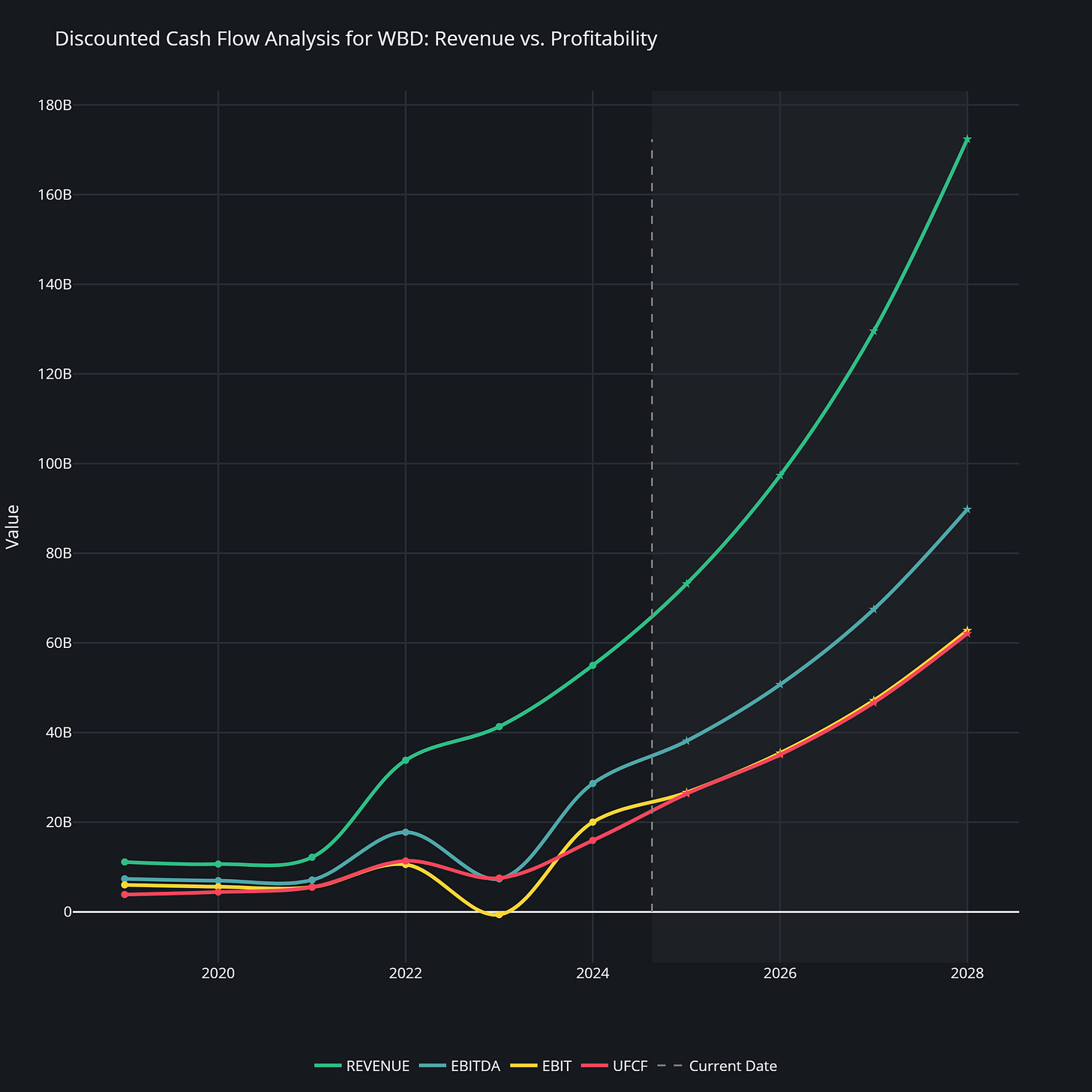

Discounted Cash Flow 🟩

Don’t understand these metrics? Here's a detailed explanation.

Those revenue projections are financial science fiction. In my two decades as a management consultant, I've seen my share of ambitious projections, but this takes the cake. Quadrupling revenue in five years in the cutthroat world of media and streaming? That's a tall order, even for a heavyweight like WBD.

EBITDA: After a 2023 nosedive (merger costs, anyone?), it's projected to skyrocket in a complete financial metamorphosis.

EBIT: WBD is projecting to go from a loss of $0.61B in 2023 to a profit of $62.76B in 2028. If they pull this off, it'll be the comeback of the century.

Unlevered Free Cash Flow: Steady growth, but still ambitious. This is the number I'll be watching closely.

The million-dollar question: What's driving these projections? Are we looking at the next streaming juggernaut, or is this Hollywood accounting at its finest?

A few possibilities:

Synergies from the Warner-Discovery merger finally kicking in

Aggressive expansion in international markets

A slate of blockbuster content that'll make competitors sweat

AI integration boosting efficiency (because every projection needs an AI angle these days)

But let's not forget the risks:

Intense competition in the streaming wars

Potential economic downturns affecting ad revenue

The ongoing shift away from traditional TV

While WBD has the content library and market position to grow significantly, these numbers seem more like a wish list than a realistic forecast, so I would approach this with caution. If WBD can deliver even half of this growth, it could be a solid long-term play. But don't bet on these Hollywood dreams just yet.

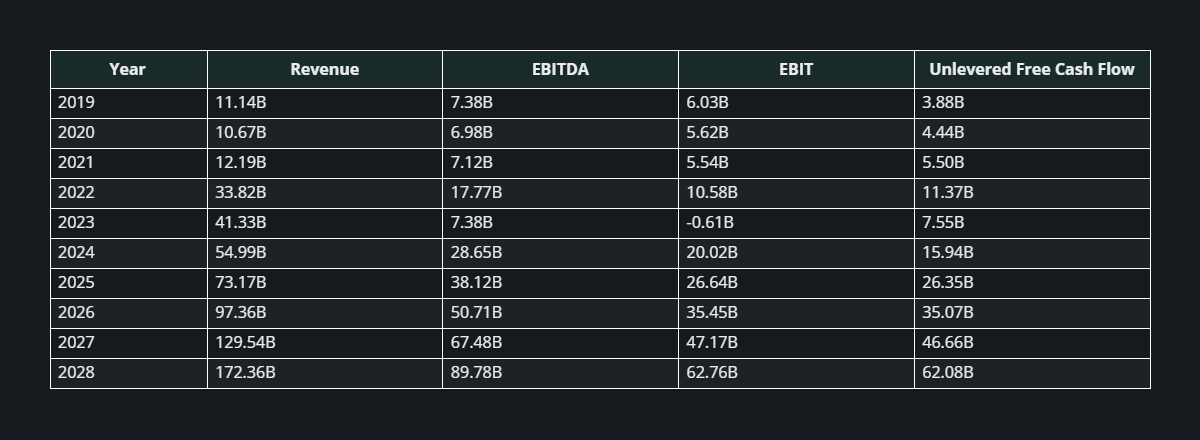

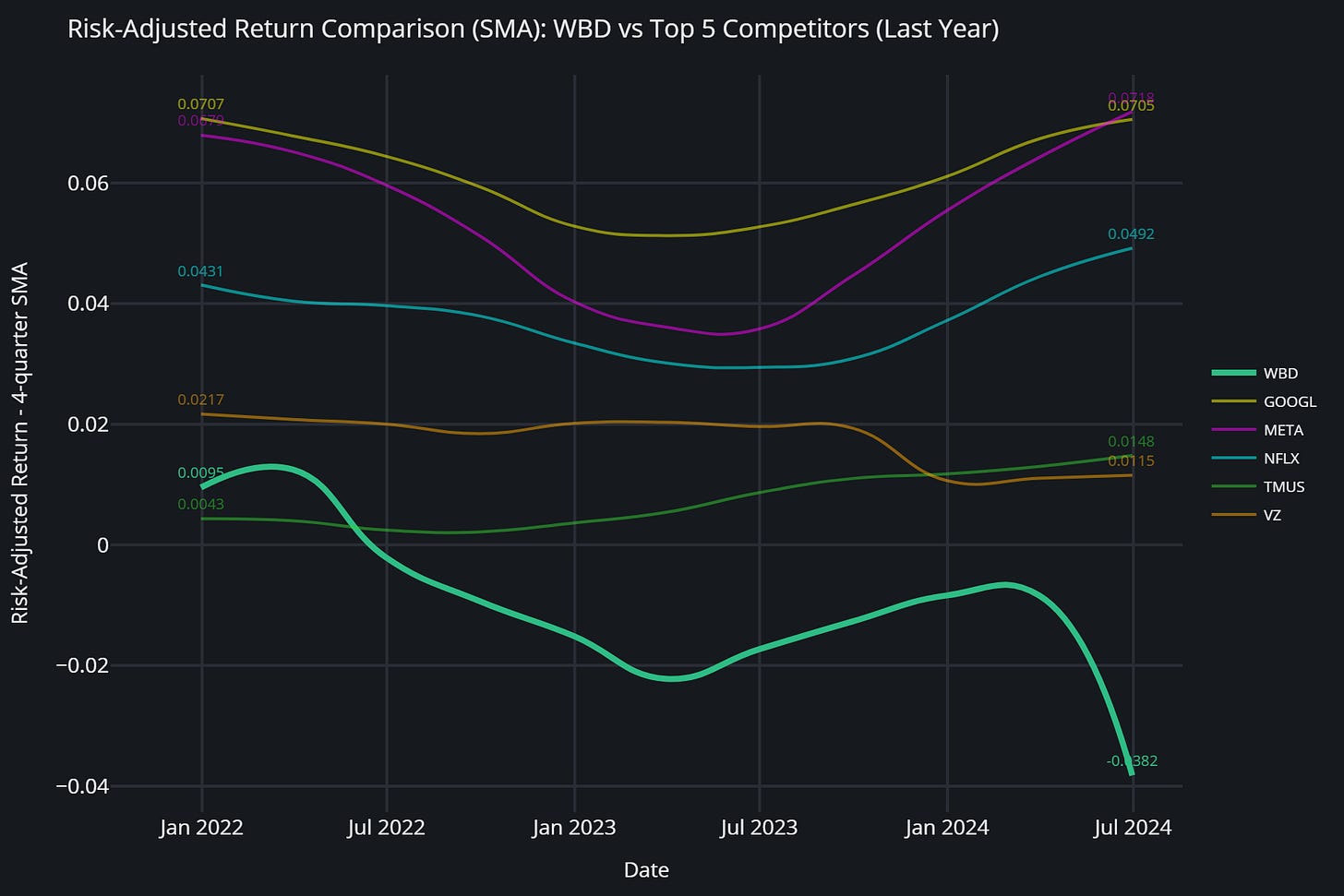

ESG 🟨

The overall trend is concerning. WBD's gone from consistently beating the benchmark to falling behind.

Environmental Score: They were ahead of the game from 2019 to 2022, but lately? Not so much. In the race for streaming dominance, are environmental concerns taking a back seat? The dip in environmental scores suggests this might be the case.

Social Score: Here's a bright spot. They're doing something right in terms of employee relations, diversity, and community engagement. In an industry where talent is everything, this could be a key advantage.

Governance Score: This is where things get ugly. We're seeing a sharp decline in 2024, with the score plummeting to 60.97, well below the benchmark. What's going on in the boardroom? The Warner-Discovery merger was bound to shake things up. It's likely impacting governance scores as the new entity finds its footing. The nosedive in governance scores is troubling. It could signal integration issues, leadership struggles, or both. This is something investors need to watch closely.

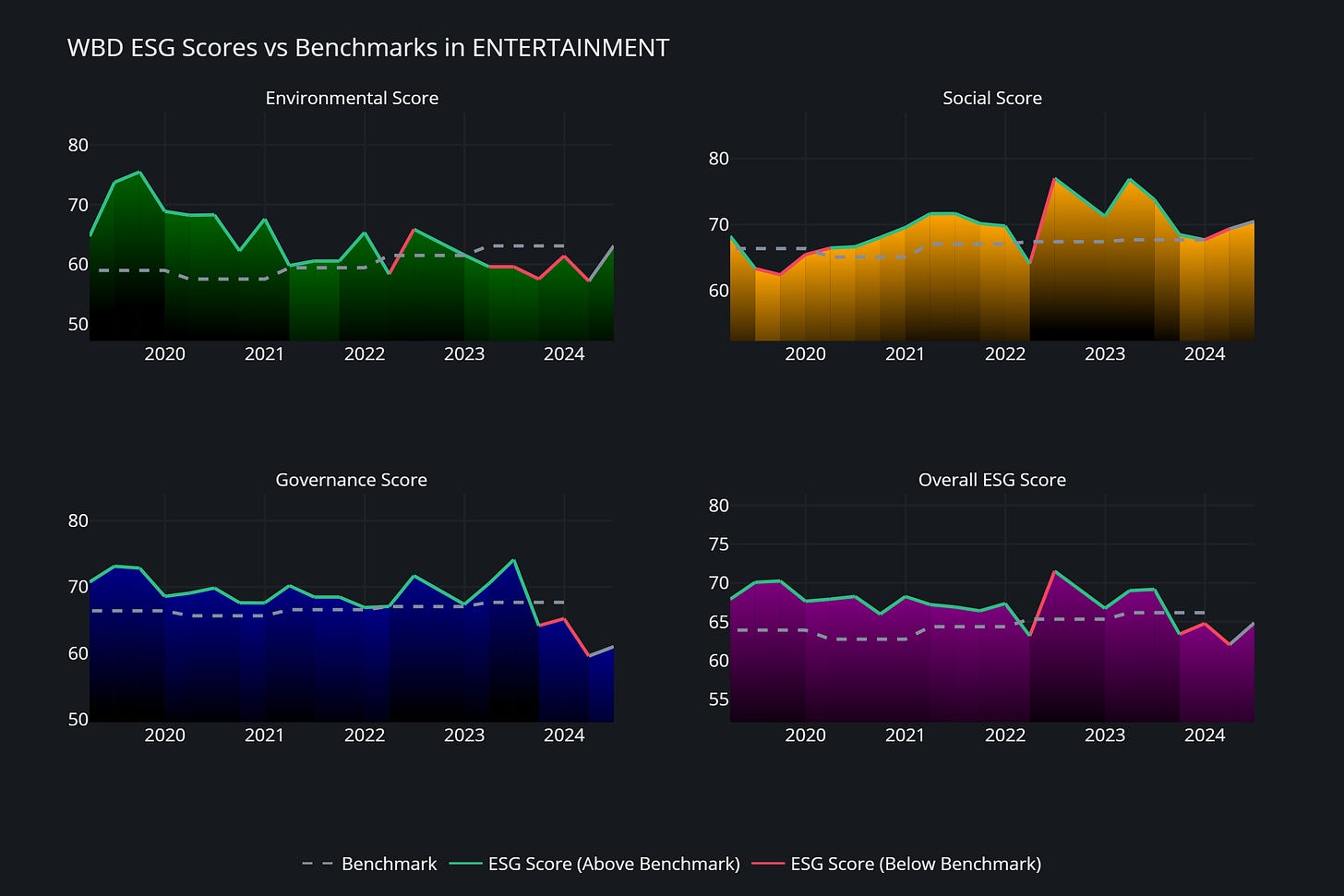

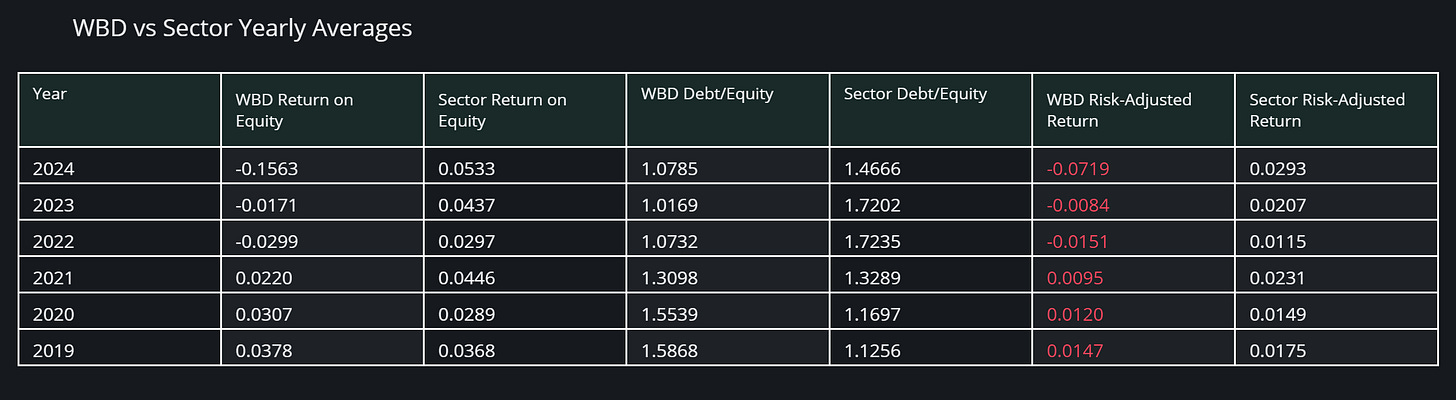

Risk-Adjusted Return 🟥

Let's break down the performance:

Return on Equity (ROE): WBD's ROE has been in negative territory for three straight years. Meanwhile, the sector's been consistently positive. The negative ROE suggests they're still struggling to turn their mega-deal into mega-profits.

Debt/Equity Ratio: WBD's actually less leveraged than the sector average. In normal times, this would be applause-worthy. But when you're underperforming, it raises the question: are they playing it too safe?

Risk-Adjusted Return: It has been negative since 2022. The sector, meanwhile, is sitting at a positive 0.029. WBD is paying for the privilege of taking risks while everyone else is getting paid. The fierce competition in streaming might be eating into margins. Are they spending too much on content without the subscriber growth to show for it?

These numbers are flashing warning signs. The negative risk-adjusted returns mean you're not being compensated for the risk you're taking.

With performance like this, expect increased scrutiny on the leadership team. A change at the top could be a catalyst - for better or worse.

For the bold, there could be a turnaround play here. If WBD can leverage its assets more effectively, the upside could be significant. But that's a big 'if'.

WBD's struggles might be early warnings for the broader media industry. Keep an eye on how other players are navigating these choppy waters.

WBD's financial performance is currently underwhelming. They've got the assets and the lower leverage to stage a comeback, but right now, the risk-reward profile is unappealing.

This is a "wait and see" situation. If you're already in, you might want to hold on for the next act - there's potential for a turnaround. But for those on the sidelines, there are probably more compelling stories to invest in right now.

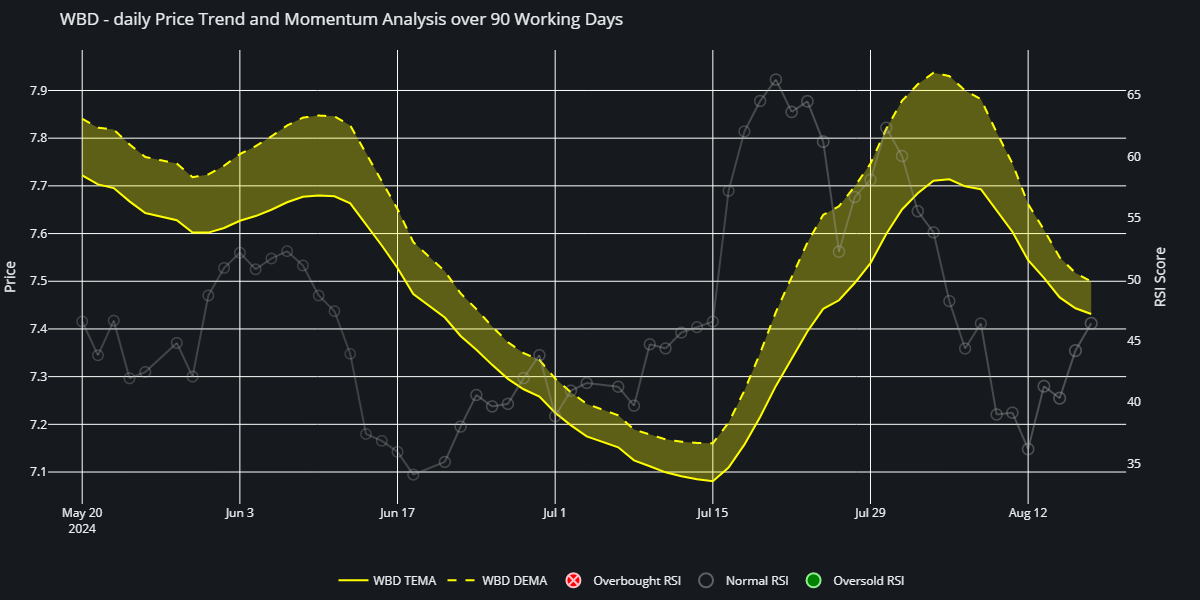

Technical Analysis 🟨

Don’t understand the chart? I explain how it works in this post.

Price Action: We've seen lows of $6.71 and highs of $8.78 in just the past three months. That's a 30% swing. Not exactly the stability you'd expect from a major media company.

Trend Analysis (TEMA & DEMA): Consistently bearish. Recently, we've seen some attempts at a crossover, but it's indecisive.

RSI and ADX: The RSI has been all over the place, dipping into oversold territory (below 30) in mid-June and flirting with overbought levels (above 70) in mid-July. As of August 16, it's sitting at a lukewarm 46.42. It's like the market can't make up its mind about WBD. ith an ADX hovering around 17.80, we're looking at a weak trend. Typically, we want to see ADX above 25 for a strong trend.

Support and Resistance: Keep an eye on the $7.00 level for support and $8.50 for resistance. These seem to be the key battlegrounds where buyers and sellers are facing off.

Watch for a Breakout: Given the consolidation we're seeing, a significant move could be brewing. A decisive break above $8.50 or below $7.00 could signal the start of a new trend.

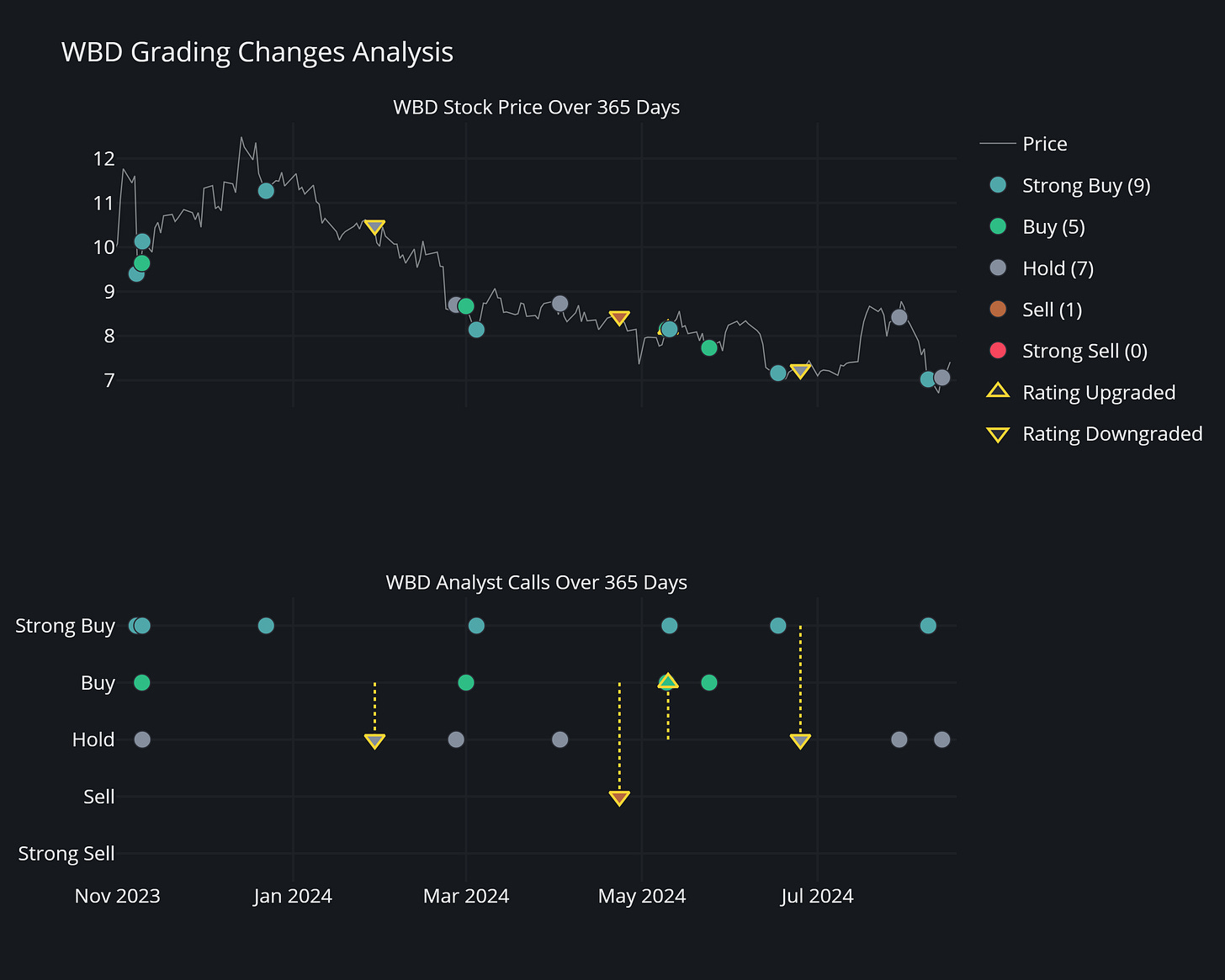

Analyst Sentiment 🟨

We're seeing a trend of lowering price targets across the board. But how low can you go?

There are some notable downgrades recently. Wells Fargo took WBD from "Overweight" to "Equal-Weight" in January. Wolfe Research went from "Outperform" to "Underperform" in April.

Several big names are sticking to their guns with "Hold" or "Equal-Weight" ratings. Morgan Stanley, Barclays, and UBS are all in this camp. Also, Goldman Sachs just initiated coverage in June with a "Neutral" rating.

Firms like Benchmark and Raymond James are maintaining their "Buy" and "Outperform" ratings.

The mixed sentiment reflects the company's potential, but also its challenges. For investors, it means doing your homework is more important than ever.

Analysts are just one part of the puzzle. They're not infallible, and sometimes the best opportunities come when the experts are scratching their heads.

Sentiment in the Media 🟥

Multiple law firms are investigating potential fraud or securities violations.

That $9.1 billion write-down has left investors reeling. Part of a broader $11.2 billion adjustment, this write-down is a stark admission of the challenges facing WBD's traditional TV business.

With executives like Kathleen Finch departing, WBD's organizational chart is in flux. It's got investors wondering about the stability of the leadership team and the overall direction of the company.

WBD's pivot to streaming is raising eyebrows. They're late to a party where Netflix and Disney+ are already well-established, and the cost of entry (content spending) is astronomical. Also, rising streaming costs are affecting everyone, but WBD seems to be particularly vulnerable to these industry-wide challenges.

WBD's stock chart is a source of concern. Even longtime supporters are reconsidering their positions.

For now, WBD is cast in the role of the underdog. The question is, can they engineer a comeback? In Hollywood, everyone loves a good turnaround story. But in the market, such narratives are harder to come by.

The Sullivan Scale

🟩 Discounted Cash Flow

🟨 ESG

🟥 Risk-Adjusted Return

🟨 Technical Analysis

🟨 Analyst Sentiment

🟥 Sentiment in the Media

We've got a company with significant challenges but also some potential for a turnaround. The abundance of yellow and red flags can't be ignored, but neither can the possibility of a comeback in this ever-changing media landscape.

The Bottom Line

The ambitious financial projections paint a picture of a company aiming for the stars, but the current performance metrics and market sentiment suggest they're still struggling to get off the launch pad. The ESG scores, particularly the declining governance rating, add another layer of complexity to an already intricate story.

From a technical standpoint, the stock's volatility reflects the market's uncertainty about WBD's future. The lack of a clear trend suggests that investors are still trying to gauge the company's post-merger direction.

The negative media sentiment and ongoing legal investigations aren't helping matters, creating a cloud of skepticism that WBD will need to dispel if it hopes to regain investor confidence.

However, WBD's vast content library, strong brand recognition, and the potential synergies from the merger could provide the foundation for a turnaround.

For investors, WBD represents a high-risk, potentially high-reward opportunity. It's not for the faint of heart or those seeking stable, predictable returns. If you're considering an investment in WBD, here are some key points to keep in mind:

Monitor quarterly reports closely to see if the company is making progress towards its ambitious growth targets.

Watch for improvements in governance scores and any strategic shifts that could indicate a more focused direction.

Keep an eye on debt reduction efforts and the company's ability to generate positive cash flow.

Pay attention to subscriber growth and content performance in the streaming space.

Be prepared for continued volatility and maintain appropriate position sizing and risk management strategies.

In the end, investing in WBD is akin to betting on a potential blockbuster that's still in pre-production. The script looks promising, but there are questions about the direction, the budget is a concern, and the critics are skeptical.

The DUQQQ Portfolio

In the DUQQQ portfolio, our stance on WBD remains cautiously optimistic, but with a keen eye on risk management. Here's our current strategy:

Holding Position: We're maintaining our WBD position for now, recognizing the potential upside if the company can successfully navigate its current challenges.

Stop-Loss in Place: Our risk-managing stop-loss is set at $7.50. This level allows us to protect our gains while still giving WBD room to maneuver through its current turbulence.

Strategic Watch: We're closely monitoring WBD's strategic moves. Any significant shifts in their streaming strategy, content development, or debt management could prompt a reassessment of our position.

Earnings Focus: Upcoming quarterly reports will be crucial. We're looking for signs of progress towards those ambitious financial projections and improvements in key metrics like subscriber growth and content performance.

Governance Improvements: Given the concerning drop in ESG governance scores, we're paying extra attention to any changes in leadership or corporate governance practices.

Industry Context: We're viewing WBD's performance within the broader context of the media industry's transformation. Their ability to adapt to the changing landscape will be key to our long-term outlook.

The DUQQQ portfolio is about balancing potential high-reward opportunities with prudent risk management. WBD exemplifies this approach.